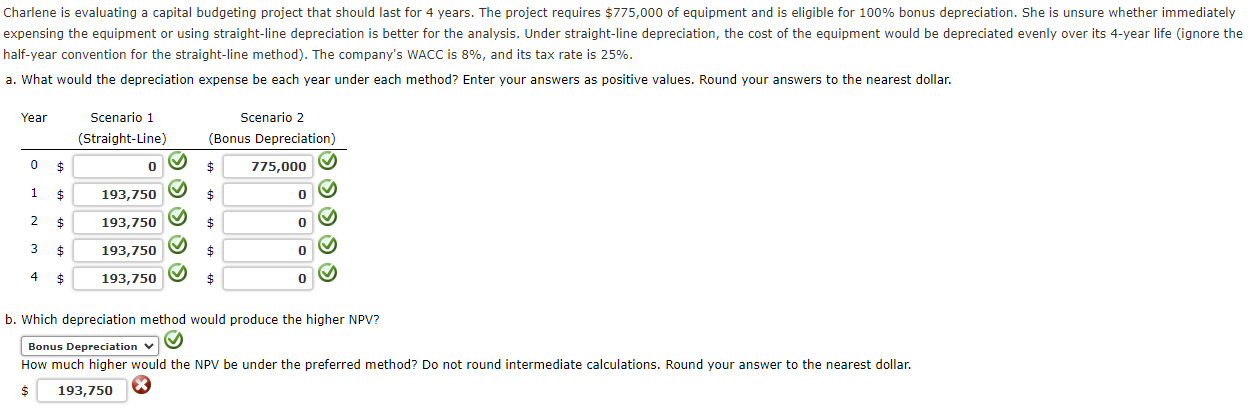

Question: Just need the last answer: How much higher would the NPV be under the preferred method? Do not round intermediate calculations. Round your answer to

Just need the last answer:

How much higher would the NPV be under the preferred method? Do not round intermediate calculations. Round your answer to the nearest dollar.

half-year convention for the straight-line method). The company's WACC is 8%, and its tax rate is 25%. a. What would the depreciation expense be each year under each method? Enter your answers as positive values. Round your answers to the nearest dollar. b. Which depreciation method would produce the higher NPV? How much higher would the NPV be under the preferred method? Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts