Question: just need the missing part plz don't waste my question if uou don't know,, On December 31,2021 , the end of its first year of

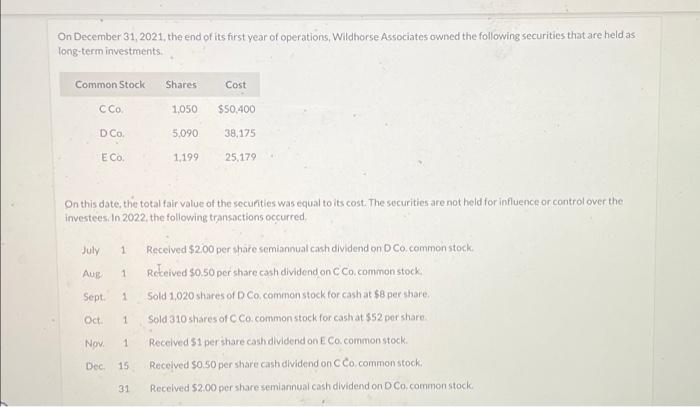

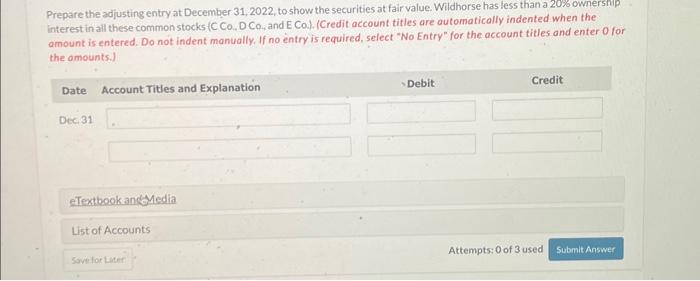

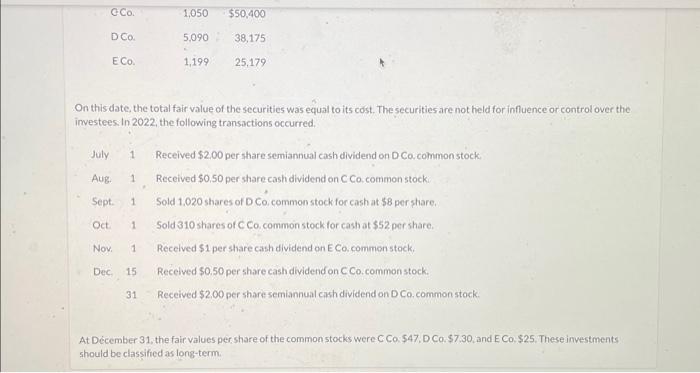

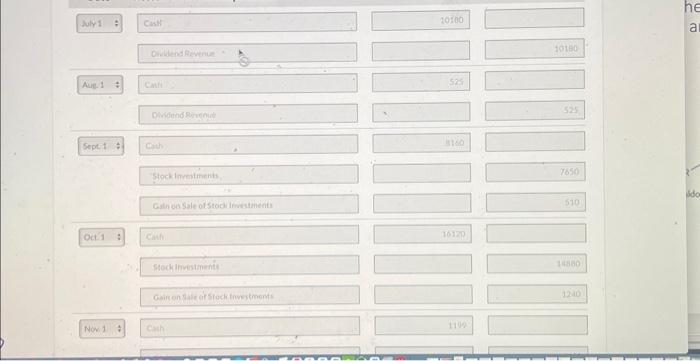

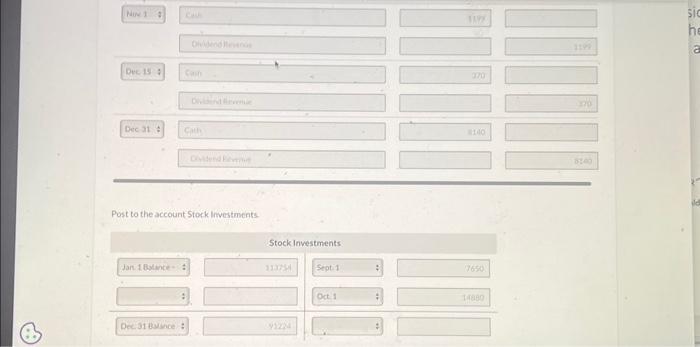

On December 31,2021 , the end of its first year of operations, Wildhorse Associates owned the following securities that are held as long-term investments. On this date, the total fair value of the securities was equal to its cost. The securities are not held for influence or control over the investees:in 2022, the following transactions occurred. July 1 Received $200 per shate semiannual cash dividend on DC0. common stock. Aug 1 Reteived So.50 per share cash dividend on C Co. common stock. Sept. 1 Sold 1,020 shares of D Co. common stock for cash at 58 per share. Oct. 1 Sold 310 shares of C Co. common stock for cash at 552 per share. Nov. 1 Recelved 51 per share cashdividend on E Co common stock. Dec. 15 Recelved $0.50 per share cash dlvidend on CCo, common stock. 31 Recelved $2.00 per share semiannual cash dividend on DC. common stock. Prepare the adjusting entry at December 31,2022 , to show the securities at fair value. Wildhorse has less than a 20% ownership interest in all these common stocks (C Co., DCo, and ECO. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) On this date, the total fair value of the securities was equal to its cost. The securities are not held for influence or control over the imvestees. In 2022, the following transactions occurred. July 1 Received $2.00 per share semiannual cash dividend on D Co. common stock, Aug. 1 Received $0,50 per share cash dividend on C Co. common stock: Sept. Sold 1.020 shares of D Co. common stock for cash at 58 per share. Oct. 1 Sold310 shares of C Co. common stock for cash at $52 per share. Nov. 1 Recelved $1 per share cash dividend on E Co. common stock. Dec. 15 Received $0.50 per share cashdividendon C Co. commonstock. 31 Received $2.00 per sharesemiannual cash dividend on D Co. common stock. At December 31, the fair values per share of the common stocks were C Co. $47,D Co. $7,30, and ECo. $25. These investments should be classified as long-term. Post to the account Stock Investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts