Question: just need the remaining blanks Perpetual Inventory using FIFO The following units of a particular item were available for sale during the calendar year: Jan

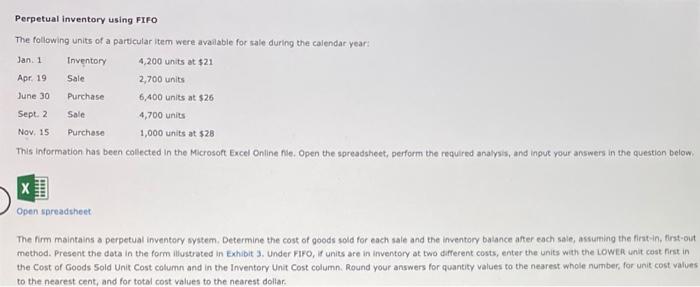

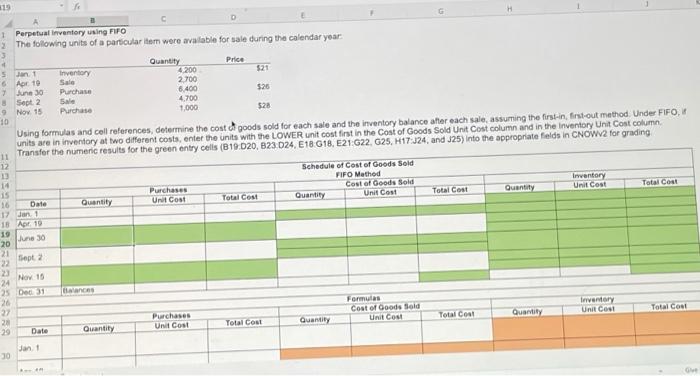

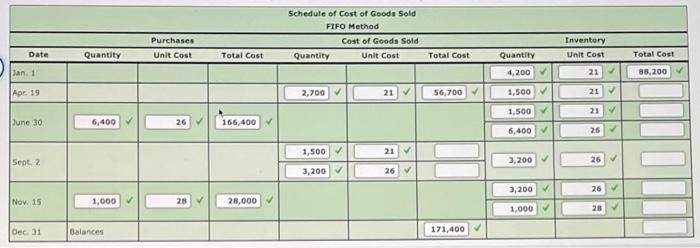

Perpetual Inventory using FIFO The following units of a particular item were available for sale during the calendar year: Jan 1 Inventory 4,200 units at $21 Apr 19 Sale 2,700 units June 30 Purchase 6,400 units at $26 Sept. 2 Sale 4,700 units Nov. 15 Purchase 1,000 units at $28 This information has been collected in the Microsoft Excel Online nie. Open the spreadsheet perform the required analysis, and input your answers in the question below 1 Open spreadsheet The firm maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the first in, first-out method. Present the data in the form illustrated in Exhibit . under FIFO, If units are in inventory at two different costs, enter the units with the LOWER unit cost est in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Round your answers for quantity values to the nearest whole number, for unit cost values to the nearest cent, and for total cost values to the nearest dollar 19 H A 1 Perpetual inventory using FIFO The following units of a particulariter were available for sale during the calendar year Quantity Price 5 Jan Inventory 4200 6 Apr 10 Sale 2.700 7 June 30 Purchase 6.400 526 8 Sept 2 Sale 4.700 9 Nov 15 Purchase 1,000 520 10 Using formulas and coll references, determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the first in first-out method Under FIFO, units are in inventory at two different costs, enter the units with the LOWER unit cost first in the cost of Goods Sold Unit Cost column and in the inventory Unit Cost column Transfer the numeric results for the green entry cells (B19.020, 023 024, E18 G18, E21:022 G25,H17:J24, and J25) Into the appropriate fields in CNOW2 for grading 12 13 Schedule of Cost of Goods Sold 14 FIFO Method 15 Purchases Cost of Goods Sold Inventory 16 Date Quantity Total Cost Unit Cost Quantity Total Cost Unit Cost Total Cost Quantity Unit Cost 17 Jan 1 18 Apr 10 19 June 30 20 21 Sept 2 REARRARA 24 Nov 15 2531 26 2 Formulas Cost of Goods Sold Unit Cost Inventory Unit Cost Total cos Total Cost Quantity Purchases Un Cost Total Cost Quantity -29 Date Quantity Jant 30 G Purchases Schedule of Cost of Goods Sold FIFO Method Cost of Goods Sold Quantity Unit Cost Date Quantity Unit Cost Total Cost Total Cost Quantity Inventory Unit Cost 21 Total Cost Isan, 4,200 88,200 Apr 19 2,700 21 56,700 1,500 21 1,500 21 June 30 6,400 26 166,400 6,400 26 1,500 Sept. 2 3,200 26 3,200 26 3,200 26 Nov 15 1,000 28 28,000 1,000 28 Dec 31 Balances 171,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts