Question: Just need this single question answered, please. Susan (a developer) has located land that she would like to buy and build on. It is currently

Just need this single question answered, please.

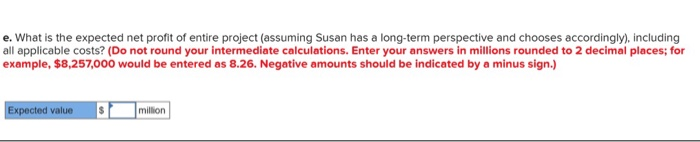

Susan (a developer) has located land that she would like to buy and build on. It is currently zoned for four homes per acre, but she is planning to request new zoning. What she builds depends on approval of zoning requests and your analysis for her. With her input and your help, the decision process has been reduced to the following costs, alternatives, and probabilities: Cost of land: $2 million, Probability of rezoning: 0.60. If the land is rezoned, there will be additional costs for new roads, lighting, and so on, of $1 million. If the land is rezoned, she must decide whether to build a shopping center or 1,500 apartments that the tentative plan shows would be possible. If she builds a shopping center, there is a 70 percent chance that she can sell the shopping center to a large department store chain for $4 million over her construction cost (excluding the land cost); and there is a 30 percent chance that she can sell it to an insurance company for $5 million over her construction cost (also excluding the land cost). If, instead of the shopping center, she decides to build the 1,500 apartments, she places probabilities on the profits as follows: There is a 60 percent chance that she can sell the apartments to a real estate investment corporation for $3,000 each over her construction cost; there is a 40 percent chance that she can get only $2,000 each over her construction cost (both excluding the land cost.) If the land is not rezoned, she will comply with the existing zoning restrictions and simply build 600 homes, on which she expects to make $4,000 over the construction cost on each one (excluding the cost of land). You don't have to use discounted cash flows for any of the following questions. e. What is the expected net profit of entire project (assuming Susan has a long-term perspective and chooses accordingly), including all applicable costs? (Do not round your intermediate calculations. Enter your answers in millions rounded to 2 decimal places; for example, $8,257,000 would be entered as 8.26. Negative amounts should be indicated by a minus sign.) Expected values million