Question: Just need to make sure if this is correct? Given the historical cost of produce ACE is $15, the selling price of ACE is $20,

Just need to make sure if this is correct?

Just need to make sure if this is correct?

Given the historical cost of produce ACE is $15, the selling price of ACE is $20, costs to sell ACE are $3, the replacement cost is

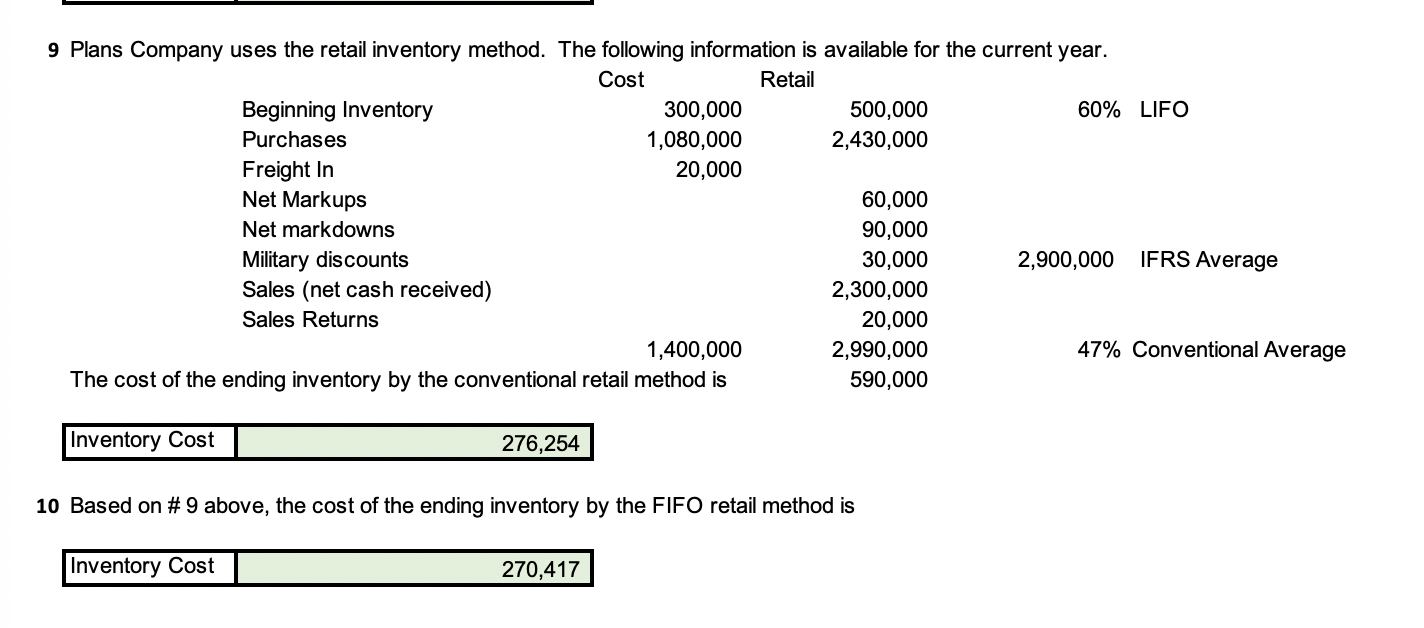

9 Plans Company uses the retail inventory method. The following information is available for the current year. Cost Retail Beginning Inventory 300,000 500,000 60% LIFO Purchases 1,080,000 2,430,000 Freight In 20,000 Net Markups 60,000 Net markdowns 90,000 Military discounts 30,000 2,900,000 IFRS Average Sales (net cash received) 2,300,000 Sales Returns 20,000 1,400,000 2,990,000 47% Conventional Average The cost of the ending inventory by the conventional retail method is 590,000 Inventory Cost 276,254 10 Based on #9 above, the cost of the ending inventory by the FIFO retail method is Inventory Cost 270,417 9 Plans Company uses the retail inventory method. The following information is available for the current year. Cost Retail Beginning Inventory 300,000 500,000 60% LIFO Purchases 1,080,000 2,430,000 Freight In 20,000 Net Markups 60,000 Net markdowns 90,000 Military discounts 30,000 2,900,000 IFRS Average Sales (net cash received) 2,300,000 Sales Returns 20,000 1,400,000 2,990,000 47% Conventional Average The cost of the ending inventory by the conventional retail method is 590,000 Inventory Cost 276,254 10 Based on #9 above, the cost of the ending inventory by the FIFO retail method is Inventory Cost 270,417

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts