Question: just need yellow boxes See The Light Projected Income Statement For the Period Ending December 31, 20x1 $ 1.125,000.00 750 000.00 375,000.00 $ Sales 25,000

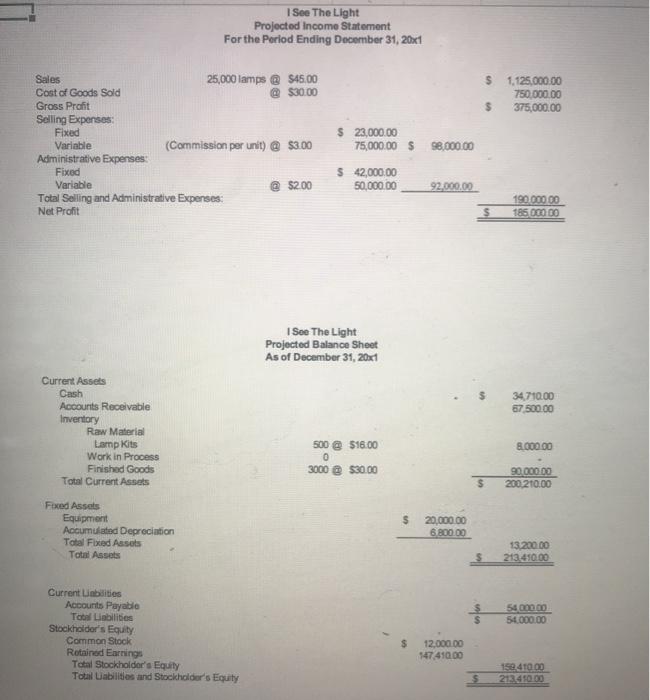

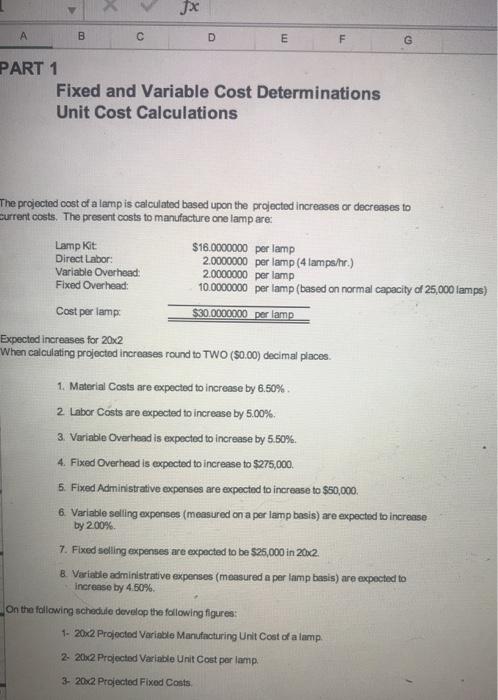

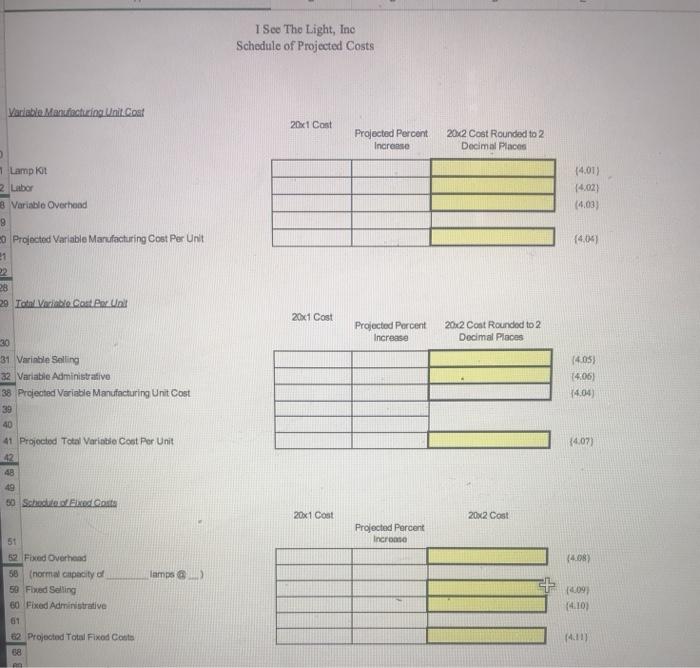

See The Light Projected Income Statement For the Period Ending December 31, 20x1 $ 1.125,000.00 750 000.00 375,000.00 $ Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $30.00 Gross Profit Selling Expenses Fixed Variable (Commission per unit) $3.00 Administrative Expenses Fixed Variable $2.00 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 75,000.00 $ 98.000.00 $ 42,000.00 50,000.00 92.000.00 190.00000 185.00000 Soe The Light Projected Balance Sheet As of December 31, 20x1 $ 34 710.00 67 500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8.000.00 500 @ $16.00 0 3000 $30.00 $ 90.000.00 200210.00 $ Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 20,000.00 6.800.00 13.200.00 213 450.00 58.000.00 54.000.00 $ Current abilities Accounts Payable Tool Liabilities Stockholder's Equity Common Stock Rotained Earnings Total Stockholder's Equity Total abilities and Stockholder's Equity 12,000.00 147,410.00 159.410.00 213.410.00 fx B D E F G PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to urrent costs. The present costs to manufacture one lamp are: Lamp kot $16.0000000 per lamp Direct Labor 2.0000000 per lamp (4 lamps/hr.) Variable Overhead 2.0000000 per lamp Fixed Overhead 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp: $30.0000000 per lamp Expected increases for 20x2 When calculating projected increases round to TWO ($0.00) decimal places 1. Material Costs are expected to increase by 6.50% 2 Labor Costs are expected to increase by 5.00% 3. Variable Overhead is expected to increase by 5.50%. 4. Fixed Overhead is expected to increase to $275,000. 5. Fixed Administrative expenses are expected to increase to $50,000 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 2.00% 7. Fixed selling expenses are expected to be $25,000 in 20x2. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 4.50% On the following schedule develop the following figures: 1- 2012 Projected Variable Manufacturing Unit Cont of a lamp 2. 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs I See The Light, Inc Schedule of Projected Costs Variable Manufacturing Unit.Com 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places 14.01) 14.02) (4.03) 1 Lamp kot 2 Labor 8 Variable Overhead 9 Projected Variable Manufacturing Cost Per Unit 1 {4.04 28 29 Total Variable Cost. Por all 20x1 Cost Projected Porcent Increase 20x2 Cost Rounded to 2 Decimal Places 30 31 Variable Selling 32 Variable Administrative 38 Projected Variable Manufacturing unit Cost 39 1405) 14.06) 14.04) 40 {4.07) 41 Projected Total Variatie Cost Per Unit 42 S 50 Schade alled Gaste 20x1 Cost 20x2 Cost Projected Porcent Incroso (4.08) 5t 52 Fixed Overhead 58 (normal capacity of 50 Fred Selling 60 Fixed Administrative lamps + (4.09 (4.102 61 14.111 62 Projected Total Fixed Coats 08 See The Light Projected Income Statement For the Period Ending December 31, 20x1 $ 1.125,000.00 750 000.00 375,000.00 $ Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $30.00 Gross Profit Selling Expenses Fixed Variable (Commission per unit) $3.00 Administrative Expenses Fixed Variable $2.00 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 75,000.00 $ 98.000.00 $ 42,000.00 50,000.00 92.000.00 190.00000 185.00000 Soe The Light Projected Balance Sheet As of December 31, 20x1 $ 34 710.00 67 500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8.000.00 500 @ $16.00 0 3000 $30.00 $ 90.000.00 200210.00 $ Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 20,000.00 6.800.00 13.200.00 213 450.00 58.000.00 54.000.00 $ Current abilities Accounts Payable Tool Liabilities Stockholder's Equity Common Stock Rotained Earnings Total Stockholder's Equity Total abilities and Stockholder's Equity 12,000.00 147,410.00 159.410.00 213.410.00 fx B D E F G PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to urrent costs. The present costs to manufacture one lamp are: Lamp kot $16.0000000 per lamp Direct Labor 2.0000000 per lamp (4 lamps/hr.) Variable Overhead 2.0000000 per lamp Fixed Overhead 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp: $30.0000000 per lamp Expected increases for 20x2 When calculating projected increases round to TWO ($0.00) decimal places 1. Material Costs are expected to increase by 6.50% 2 Labor Costs are expected to increase by 5.00% 3. Variable Overhead is expected to increase by 5.50%. 4. Fixed Overhead is expected to increase to $275,000. 5. Fixed Administrative expenses are expected to increase to $50,000 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 2.00% 7. Fixed selling expenses are expected to be $25,000 in 20x2. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 4.50% On the following schedule develop the following figures: 1- 2012 Projected Variable Manufacturing Unit Cont of a lamp 2. 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs I See The Light, Inc Schedule of Projected Costs Variable Manufacturing Unit.Com 20x1 Cost Projected Percent Increase 20x2 Cost Rounded to 2 Decimal Places 14.01) 14.02) (4.03) 1 Lamp kot 2 Labor 8 Variable Overhead 9 Projected Variable Manufacturing Cost Per Unit 1 {4.04 28 29 Total Variable Cost. Por all 20x1 Cost Projected Porcent Increase 20x2 Cost Rounded to 2 Decimal Places 30 31 Variable Selling 32 Variable Administrative 38 Projected Variable Manufacturing unit Cost 39 1405) 14.06) 14.04) 40 {4.07) 41 Projected Total Variatie Cost Per Unit 42 S 50 Schade alled Gaste 20x1 Cost 20x2 Cost Projected Porcent Incroso (4.08) 5t 52 Fixed Overhead 58 (normal capacity of 50 Fred Selling 60 Fixed Administrative lamps + (4.09 (4.102 61 14.111 62 Projected Total Fixed Coats 08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts