Question: just number one please. thank you!! E7-10 (Static) Evaluating the Effects of Inventory Methods on Income from Operations, Income Taxes, and Net Income (Periodic) [LO

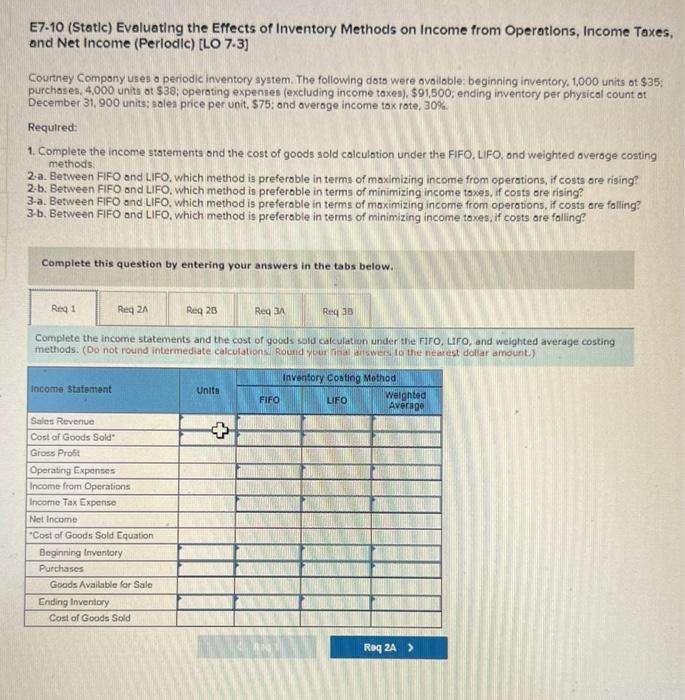

E7-10 (Static) Evaluating the Effects of Inventory Methods on Income from Operations, Income Taxes, and Net Income (Periodic) [LO 7.3] Courtney Company uses a periodic inventory system. The following data were available: beginning inventory. 1.000 units of $35: purchases, 4,000 units at $38: operating expenses (excluding income taxes). $91,500; ending inventory per physical count of December 31,900 units: sales price per unit, $75; and average income tax rate, 30%. Required: 1. Complete the income statements and the cost of goods sold calculation under the FIFO, LIFO, and weighted average costing methods 2-a. Between FIFO and LIFO which method is preferable in terms of maximizing income from operations, if costs are rising? 2-b. Between FIFO and LIFO, which method is preferable in terms of minimizing income taxes, if costs are rising 3-a. Between FIFO and LIFO, which method is preferable in terms of maximizing income from operations, if costs are falling 3-b. Between FIFO and LIFO, which method is preferable in terms of minimizing income taxes, if costs are falling? Complete this question by entering your answers in the tabs below. Reg 1 Req 21 Reg 20 Req3 Red 35 Complete the income statements and the cost of goods sold calculation under the firo, uro, and weighted average costing methods. (Do not round Intermediate calculation Round your altswers to the nearest dollar amount.) Inventory Coating Motod Income Statement Units FIFO LIFO Weighted Average Sales Revenue Cost of Goods Sold" Gross Profit Operating Expenses Income from Operations Income Tax Expense Net Income *Cost of Goods Sold Equation Beginning Inventory Purchases Goods Available for Sale Ending Inventory Cost of Goods Sold Req2A >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts