Question: just only C part is needed. A and B are solved Current Attempt in Progress Colt Division had the following results for the year just

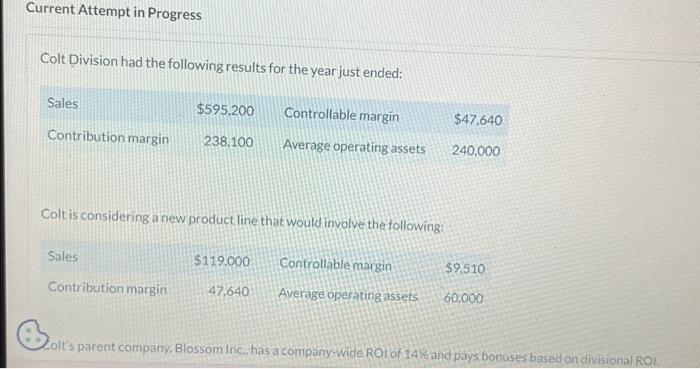

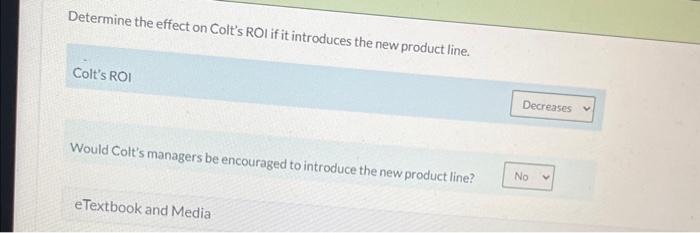

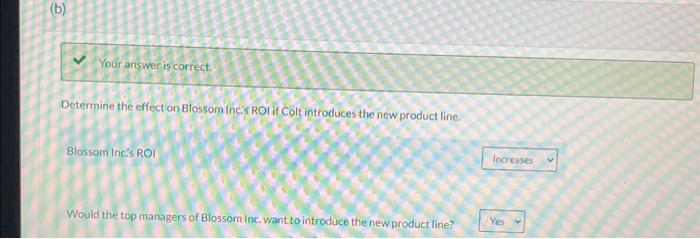

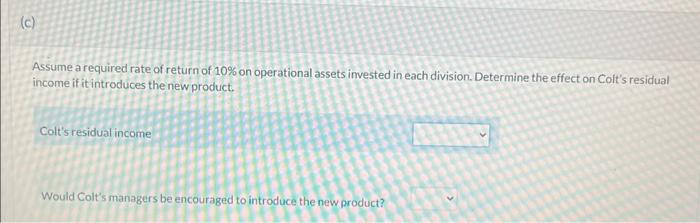

Current Attempt in Progress Colt Division had the following results for the year just ended: Colt is considering a new product line that would involve the following: 2olt's parent company, Blossom Inc, has a company-Wide ROl of 14% and pays bonuses based on divisional ROI. Determine the effect on Colt's ROI if it introduces the new product line. Colt's ROI Would Colt's managers be encouraged to introduce the new product line? Determine the effect on Blossom Inc's ROl if Colt introduces the new product line. Blossom inc's ROI Would the top managers of Blossom Inc. want to introduce the new product line? Assume a required rate of return of 10% on operational assets imvested in each division. Determine the effect on Coft's residual income if it introduces the new product. Colt's residual income Would Colt's managers be encouraged to introduce the new product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts