Question: Just part B please NEXT Exercise 11-13 (Part Level Submission) Tamarisk Company constructed a building at a cost of $2,728,000 and occupied it beginning in

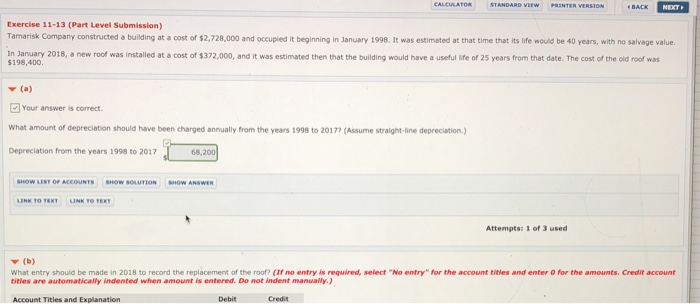

NEXT Exercise 11-13 (Part Level Submission) Tamarisk Company constructed a building at a cost of $2,728,000 and occupied it beginning in January 1998. It was estimated at that time that its life would be 40 years, with no salvage value. In January 2018, a new roof was installed at a cost of $372,000, and it was estimated then that the building would have a useful life of 25 years from that date. The cost of the old roof was $198,400. ? (a) Your answer is correct What amount of depreciation should have been charged annually from the years 1998 to 20177 (Assume straight-line depreciation.) Depreciation from the years 1998 to 2017 10 20,.0 68,200 LEST 0 OF ACCOUNTS SHOW SOLUTION SHOW TO TEXY INK TO Attempts: 1 of 3 used What entry should be made in 2018 to record the replacement of the roof? (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts