Question: Just part B please on the place i got wrong: In 2 0 2 4 , Aurora received a $ 5 0 , 7 0

Just part B please on the place i got wrong: In Aurora received a $ bonus computed as a percentage of pro

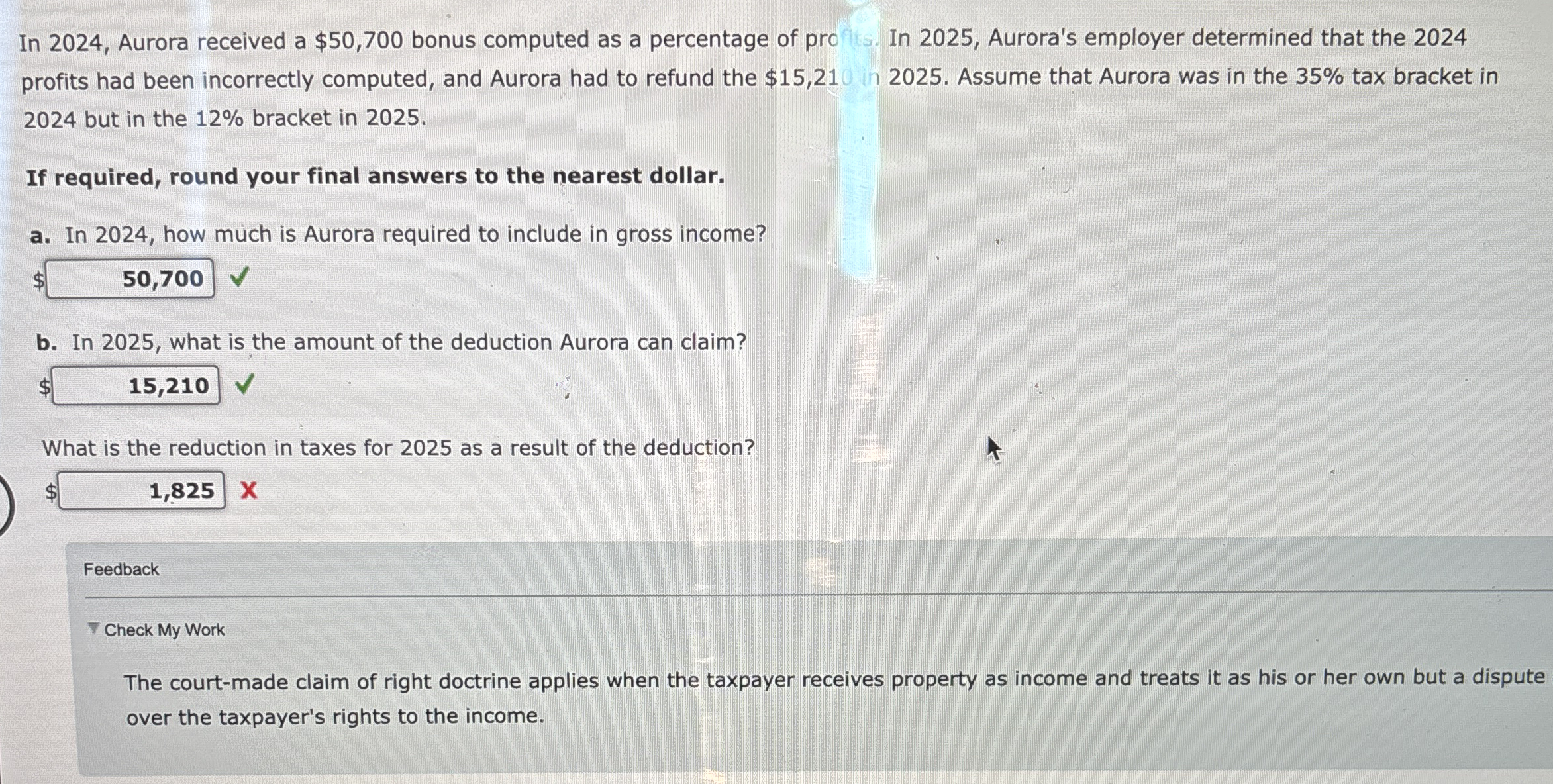

In Aurora's employer determined that the profits had been incorrectly computed, and Aurora had to refund the $ Assume that Aurora was in the tax bracket in but in the bracket in

If required, round your final answers to the nearest dollar.

a In how much is Aurora required to include in gross income?

$

b In what is the amount of the deduction Aurora can claim?

$

What is the reduction in taxes for as a result of the deduction? $ X

Feedback

Check My Work

The courtmade claim of right doctrine applies when the taxpayer receives property as income and treats it as his or her own but a dispute over the taxpayer's rights to the income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock