Question: JUST PART C please explain C (I know the answer is on there but could you go through it step by step from how immunization

JUST PART C

please explain C (I know the answer is on there but could you go through it step by step from how immunization works?

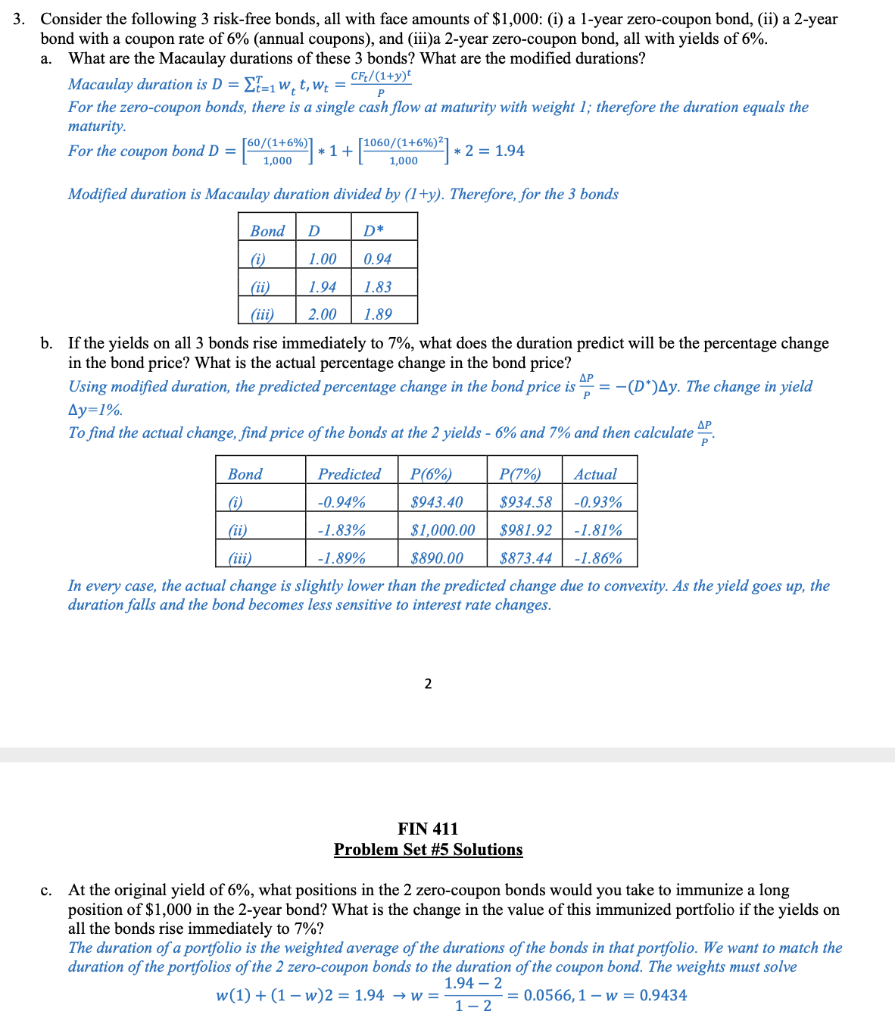

Consider the following 3 risk-free bonds, all with face amounts of $1,000 : (i) a 1-year zero-coupon bond, (ii) a 2-year bond with a coupon rate of 6% (annual coupons), and (iii)a 2-year zero-coupon bond, all with yields of 6%. a. What are the Macaulay durations of these 3 bonds? What are the modified durations? Macaulay duration is D=t=1Twtt,wt=PCFt/(1+y)t For the zero-coupon bonds, there is a single cash flow at maturity with weight 1; therefore the duration equals the maturity. For the coupon bond D=[1,00060/(1+6%)]1+[1,0001060/(1+6%)2]2=1.94 Modified duration is Macaulay duration divided by (1+y). Therefore, for the 3 bonds b. If the yields on all 3 bonds rise immediately to 7%, what does the duration predict will be the percentage change in the bond price? What is the actual percentage change in the bond price? Using modified duration, the predicted percentage change in the bond price is PP=(D+)y. The change in yield y=1% To find the actual change, find price of the bonds at the 2 yields - 6% and 7% and then calculate PP. In every case, the actual change is slightly lower than the predicted change due to convexity. As the yield goes up, the duration falls and the bond becomes less sensitive to interest rate changes. FIN 411 Problem Set \#5 Solutions c. At the original yield of 6%, what positions in the 2 zero-coupon bonds would you take to immunize a long position of $1,000 in the 2-year bond? What is the change in the value of this immunized portfolio if the yields on all the bonds rise immediately to 7% ? The duration of a portfolio is the weighted average of the durations of the bonds in that portfolio. We want to match the duration of the portfolios of the 2 zero-coupon bonds to the duration of the coupon bond. The weights must solve w(1)+(1w)2=1.94w=121.942=0.0566,1w=0.9434

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts