Question: just part C please with work In early 2018, Qualcomm Inc. had $21 billion in debt, total equity capitalization of $79 billion, and an equity

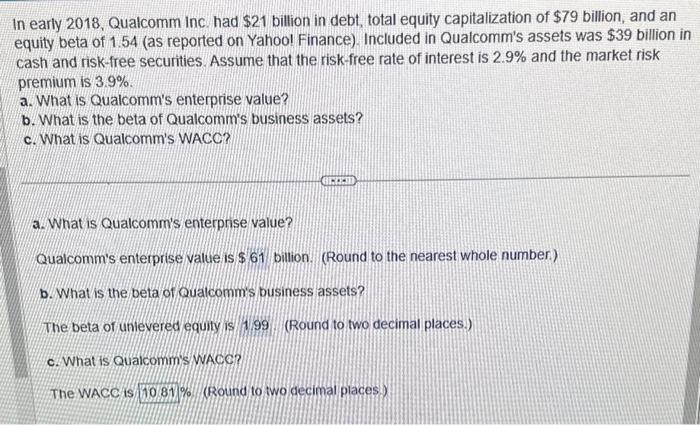

In early 2018, Qualcomm Inc. had $21 billion in debt, total equity capitalization of $79 billion, and an equity beta of 1.54 (as reported on Yahool Finance). Included in Qualcomm's assets was $39 billion in cash and risk-free securities. Assume that the risk-free rate of interest is 2.9% and the market risk premium is 3.9%. a. What is Qualcomm's enterprise value? b. What is the beta of Qualcomm's business assets? c. What is Qualcomm's WACC? a. What is Qualcomm's enterprise value? Qualcomm's enterprise value is $61 billion. (Round to the nearest whole number.) b. What is the beta of Qualcomm's business assets? The beta of unievered equity is 1.99. (Round to two decimal places.) c. What is Qualcomm's WACC? The WACC is % (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts