Question: JUST POST ANSWER DONT NEED STEPS (This will be faster and ill give thumbsup) You are given the following discount factors: t (years) 0.25 0.5

JUST POST ANSWER DONT NEED STEPS (This will be faster and ill give thumbsup)

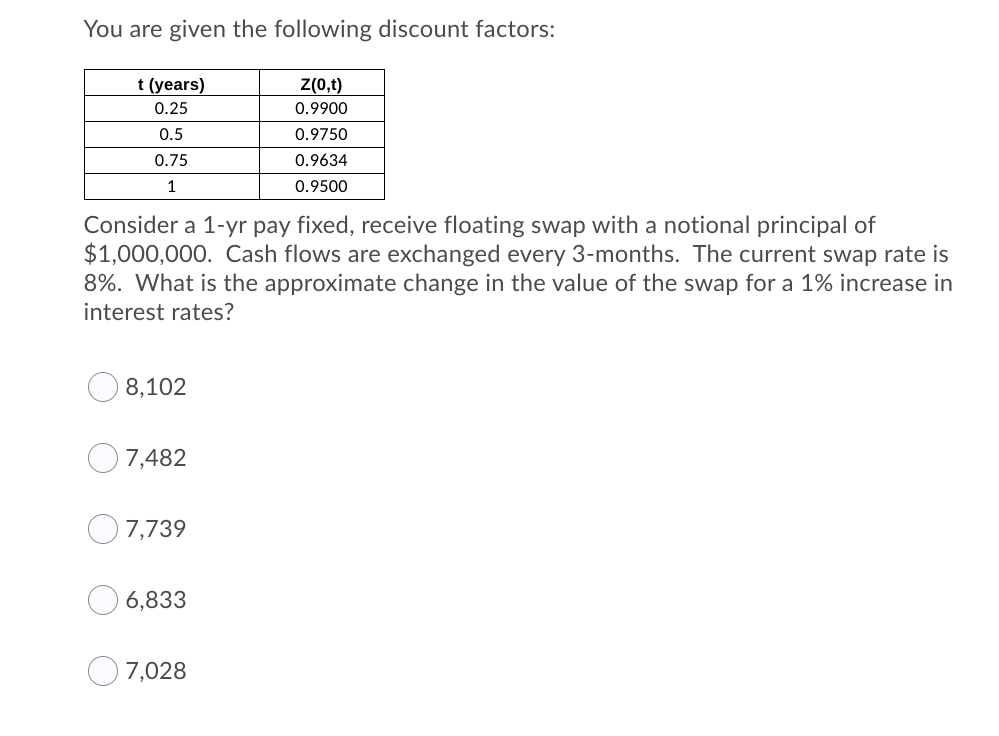

You are given the following discount factors: t (years) 0.25 0.5 0.75 1 Z(0,t) 0.9900 0.9750 0.9634 0.9500 Consider a 1-yr pay fixed, receive floating swap with a notional principal of $1,000,000. Cash flows are exchanged every 3-months. The current swap rate is 8%. What is the approximate change in the value of the swap for a 1% increase in interest rates? 8,102 7,482 7,739 6,833 7,028 You are given the following discount factors: t (years) 0.25 0.5 0.75 1 Z(0,t) 0.9900 0.9750 0.9634 0.9500 Consider a 1-yr pay fixed, receive floating swap with a notional principal of $1,000,000. Cash flows are exchanged every 3-months. The current swap rate is 8%. What is the approximate change in the value of the swap for a 1% increase in interest rates? 8,102 7,482 7,739 6,833 7,028

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts