Question: Just problem 3 EE Problems In the problems below, you can use a market risk premium of 5.5% and a tax rate of 40% where

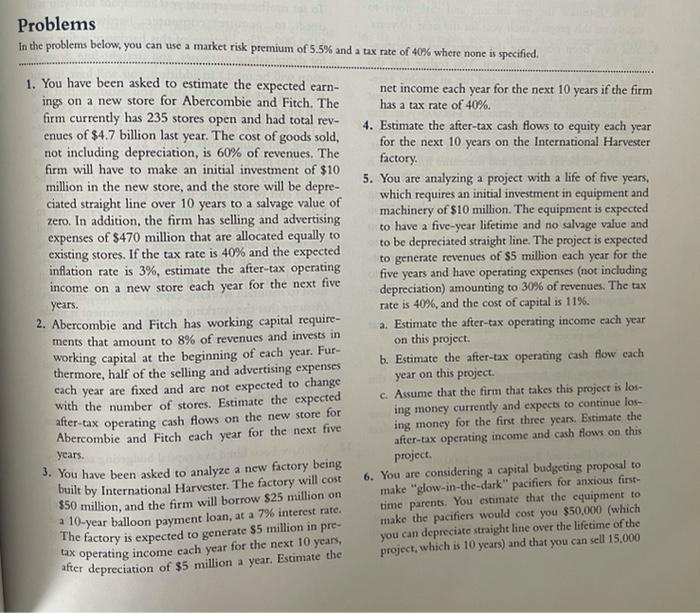

EE Problems In the problems below, you can use a market risk premium of 5.5% and a tax rate of 40% where none is specified. 1. You have been asked to estimate the expected earn- ings on a new store for Abercombie and Fitch. The net income each year for the next 10 years if the firm firm currently has 235 stores open and had total rev- has a tax rate of 40% enues of $4.7 billion last year. The cost of goods sold, 4. Estimate the after-tax cash flows to equity each year not including depreciation, is 60% of revenues. The for the next 10 years on the International Harvester firm will have to make an initial investment of $10 factory. million in the new store, and the store will be depre- 5. You are analyzing a project with a life of five years, ciated straight line over 10 years to a salvage value of which requires an initial investment in equipment and zero. In addition, the firm has selling and advertising machinery of $10 million. The equipment is expected expenses of $470 million that are allocated equally to to have a five-year lifetime and no salvage value and existing stores. If the tax rate is 40% and the expected to be depreciated straight line. The project is expected inflation rate is 3%, estimate the after-tax operating to generate revenues of $5 million each year for the five years and have operating expenses (not including income on a new store each year for the next five depreciation) amounting to 30% of revenues. The tax years. rate is 40%, and the cost of capital is 11%. 2. Abercombie and Fitch has working capital require- a. Estimate the after-tax operating income cach year ments that amount to 8% of revenues and invests in on this project working capital at the beginning of each year. Fur- thermore, half of the selling and advertising expenses b. Estimate the after-tax operating cash flow each cach year on this project. year are fixed and are not expected to change with the number of stores. Estimate the expected c. Assume that the firm that takes this project is los- after-tax operating cash flows on the new store for ing money currently and expects to continue los Abercombie and Fitch each year for the next five ing money for the first three years. Estimate the years. after-tax operating income and cash flows on this project 3. You have been asked to analyze a new factory being built by International Harvester. The factory will cost 6. You are considering a capital budgeting proposal to make "glow-in-the-dark" pacifiers for anxious first- $50 million, and the firm will borrow $25 million on time parents. You estimate that the equipment to a 10-year balloon payment loan, at a 7% interest rate. make the pacifiers would cost you $50,000 (which The factory is expected to generate $5 million in pre- you can depreciate straight line over the lifetime of the tax operating income each year for the next 10 years, project, which is 10 years) and that you can sell 15.000 after depreciation of $5 million a year. Estimate the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts