Question: Just Question 1 Just Question 1A and 2A. m. 3 Buckeye Department Stores, Inc., operates a chain of department stores in Ohio. The company's organization

Just Question 1

Just Question 1A and 2A.

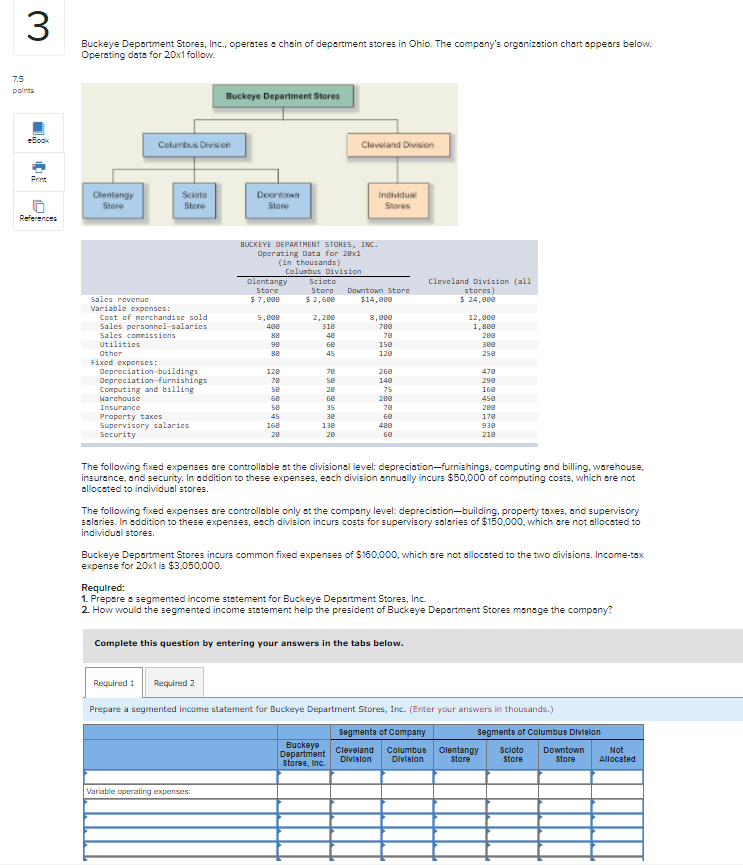

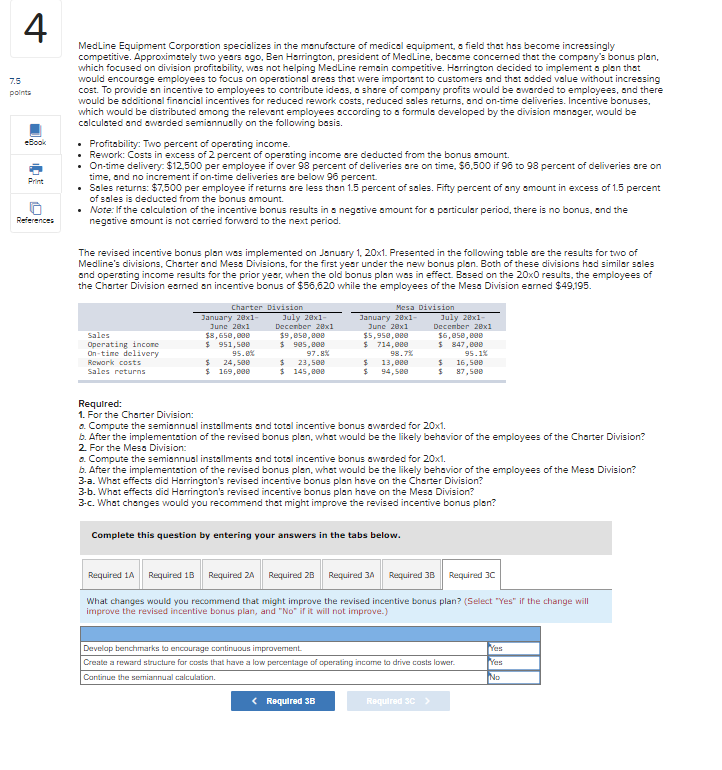

m. 3 Buckeye Department Stores, Inc., operates a chain of department stores in Ohio. The company's organization chart appears below. Operating data for 20x1 follow. 7.5 points Buckeye Department Stores ebook Columbus Division Cleveland Division Print Clentang Store Sciato Store Certon Store Individual Stores References BUCKEYE DEPARTMENT STORES, INC. Operating Data for 2x1 (in thousands) Columbus Division Olentangy Scioto Store Store Downtown Store $ 7,00 $ 2,620 $14, ege 2,200 5,292 40e se 9e Cleveland Division (all stores) $ 24,00 12.ee 1,800 zea 3ea 25a 310 8,000 7ee 7e 150 120 40 60 45 Sales revenue Variable expenses: Cost of merchandise sold Sales personnel salaries Sales commissions Utilities Other Fixed expenses: Depreciation buildings Depreciation-furnishings Computing and billing Warehouse Insurance Property taxes Supervisory salaries Security 120 78 5e be 52 45 160 20 70 se 2e 60 35 30 130 20 260 140 75 280 7e be 4ee be 470 292 16a 45e zea 17a 93a 21a The following fixed expenses are controllable at the divisional level: depreciation-furnishings, computing and billing, warehouse. insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs, which are not allocated to individual stores. The following fixed expenses are controllable only at the company level: depreciation-building property taxes, and supervisory salaries. In addition to these expenses, esch division incurs costs for supervisory salaries of $150,000, which are not allocated to individual stores Buckeye Department Stores incurs common fixed expenses of $160,000, which are not allocated to the two divisions. Income-tex expense for 20x1 is $3.050.000 Required: 1. Prepare a segmented income statement for Buckeye Department Stores, Inc. 2. How would the segmented income statement help the president of Buckeye Department Stores manage the company? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a segmented income statement for Buckeye Department Stores, Inc. (Enter your answers in thousands.) a Segments of Company Segments of Columbus Division Buckeye Cleveland Department Columbus Olentangy Scioto Downtown Not Division Division Stores, Inc. Store Store Store Allocated Variable operating expenses 4 7.5 points MedLine Equipment Corporation specializes in the manufacture of medical equipment, a field that has become increasingly competitive. Approximately two years ago, Ben Harrington, president of MedLine, became concerned that the company's bonus plan, which focused on division profitability, was not helping Medline remain competitive. Harrington decided to implemento plan that would encourage employees to focus on operational areas that were important to customers and thet edded value without increasing cost. To provide an incentive to employees to contribute ideas, a share of company profits would be awarded to employees, and there would be additional financial incentives for reduced rework costs, reduced sales returns, and on-time deliveries. Incentive bonuses, which would be distributed among the relevant employees according to a formuls developed by the division mensger, would be calculated and awarded semiannually on the following basis. Profitability: Two percent of operating income. Rework: Costs in excess of 2 percent of operating income are deducted from the bonus amount. On-time delivery: $12.500 per employee if over 98 percent of deliveries are on time, $6.500 if 95 to 98 percent of deliveries are on time, and no increment if on-time deliveries are below 96 percent. Sales returns $7.500 per employee if returns are less than 1.5 percent of sales. Fifty percent of any amount in excess of 1.5 percent of sales is deducted from the bonus amount. Note: If the calculation of the incentive bonus results in a negative amount for a particular period, there is no bonus, and the negative amount is not carried forward to the next period. ebook Print References The revised incentive bonus plan was implemented on January 1, 20x1. Presented in the following table are the results for two of Medline's divisions, Charter and Mess Divisions, for the first year under the new bonus plan. Both of these divisions had similar sales and operating income results for the prior year, when the old bonus plan was in effect. Besed on the 20x0 results, the employees of the Charter Division esmed en incentive bonus of $56,620 while the employees of the Mesa Division earned $49,195. Charter Division Mesa Division January 20x1 July 20x1 January 28x1 June 2ex1 July 2x1 Decenber 28x1 June 20x1 December 201 Sales $8,650,00 $9,050.000 $5,958,ese 56,650.000 Operating incom $ 951,500 $ 995.000 $ 714,000 $ 847.000 On-time delivery 95.0% 97.8% 98.7% 95.1% Rework costs $ 24,500 $ 23,500 $ 13,000 $ 16,500 Sales returns $ 169,220 $ 145,000 $ 94,52e 87.500 $ Required: 1. For the Charter Division: a. Compute the semiannual installments and total incentive bonus awarded for 20x1. b. After the implementation of the revised bonus an, what would be the likely behavior of the em of the Charter Division? 2. For the Mesa Division: 2. Compute the semiannual installments and total incentive bonus awarded for 20x1. b. After the implementation of the revised bonus plen, what would be the likely behavior of the employees of the Mess Division? 3-a. Whet effects did Harrington's revised incentive bonus plan have on the Charter Division? 3-b. What effects did Harrington's revised incentive bonus plan have on the Mesa Division? 3-c. What changes would you recommend that might improve the revised incentive bonus plan? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Required 3A Required 3B Required 3C What changes would you recommend that might improve the revised incentive bonus plan? (Select "Yes" if the change will improve the revised incentive bonus plan, and "No" if it will not improve.) Develop benchmarks to encourage continuous improvement Create a reward structure for costs that have a low percentage of operating income to drive costs lower. Continue the semiannual calculation Yes Yes NO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts