Question: just question 2 needed Question 1 FTE Tern Ltd has a project with a $15 million outlay that will be funded by 40 percent debt

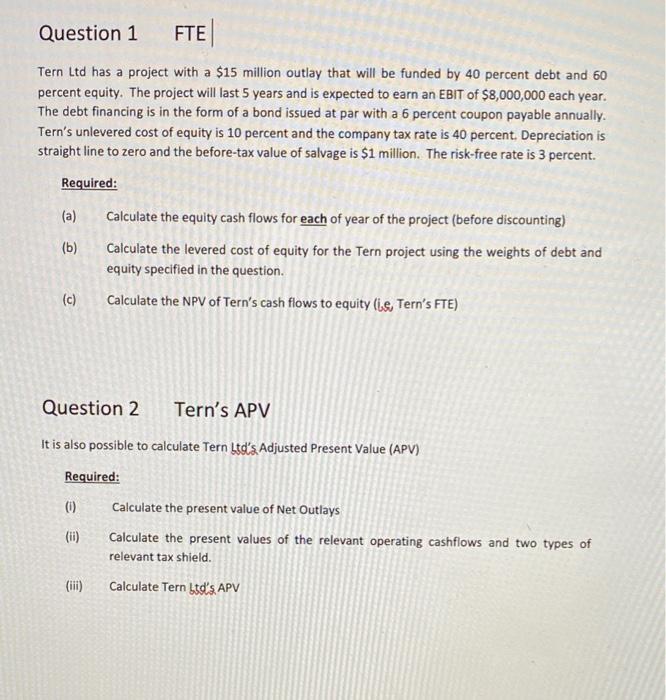

Question 1 FTE Tern Ltd has a project with a $15 million outlay that will be funded by 40 percent debt and 60 percent equity. The project will last 5 years and is expected to earn an EBIT of $8,000,000 each year. The debt financing is in the form of a bond issued at par with a 6 percent coupon payable annually. Tern's unlevered cost of equity is 10 percent and the company tax rate is 40 percent. Depreciation is straight line to zero and the before-tax value of salvage is $1 million. The risk-free rate is 3 percent. Required: (a) Calculate the equity cash flows for each of year of the project (before discounting) (b) Calculate the levered cost of equity for the Tern project using the weights of debt and equity specified in the question. (c) Calculate the NPV of Tern's cash flows to equity (le, Tern's FTE) . Question 2 Tern's APV It is also possible to calculate Tern Ltd's Adjusted Present Value (APV) Required: 0 (ii) Calculate the present value of Net Outlays Calculate the present values of the relevant operating cashflows and two types of relevant tax shield. Calculate Tern Ltd's APV (iii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts