Question: just question 8 please S. Using the information from the previous problem, record the appropriate journal entries: a. Purchasing direct materials. b. Placing direct material

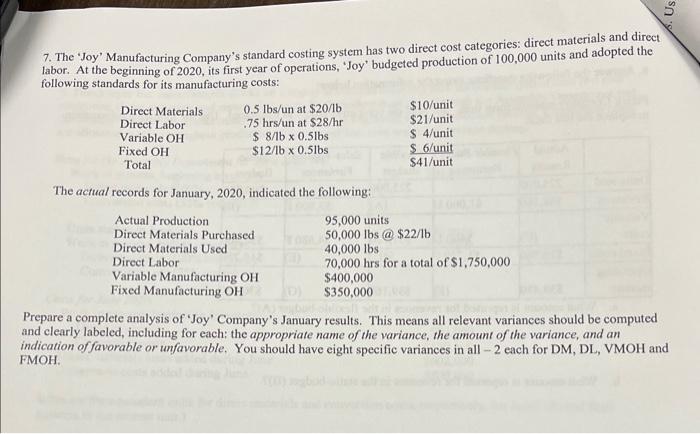

S. Using the information from the previous problem, record the appropriate journal entries: a. Purchasing direct materials. b. Placing direct material into production. c. Payroll to produce the 95,000 units. d. Allocating manuficturing overhead to the 95,000 units produced. c. Incurrence of manufacturing overhead. Fixed manufacturing overhead was composed of $200,000 of depreciation on plant, property, and equipment and $150,000 of indirect labor. Variable manufacturing overhead was all utilities. f. Closing all overhend accounts (recognize/record the variances). g. Completion of production on 95,000 units (no units left in WIP). h. Sale of 50,000 units on account for $55.00/ unit. (Record all entries related to this sale.) 7. The 'Joy' Manufacturing Company's standard costing system has two direct cost categories: direct materials and direct labor. At the beginning of 2020 , its first year of operations, 'Joy' budgeted production of 100,000 units and adopted the following standards for its manufacturing costs: The actual records for January, 2020, indicated the following: Prepare a complete analysis of 'Joy' Company's January results. This means all relevant variances should be computed and clearly labeled, including for each; the appropriate name of the variance, the amount of the variance, and an indication of favorable or unfavorable, You should have eight specific variances in all - 2 each for DM, DL, VMOH and FMOH. 5. Using the information from the previous problem, record the appeopriate journal entries. a. Purchasing direct materials. b. Placing direct material into production. c. Payroll to produce the 95,000 units. d. Allocating manufacturing overhend to the 95,000 units produced. e. Incurrence of manufacturing overhead. Fixed manufacturing overbead was composed of $200,000 of depreciation on plant, property, and equipment and \$150,000 of indirect labor. Variable manufacturing overtiead was all utilities. f. Closing all overhead accounts (recognize/record the variances). g. Completion of production on 95,000 units (no units left in WIP). Sale of 50,000 units on account for $55.00/ unit. (Record all entries related to this sale.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts