Question: Just questions D and E please Problem 1: Firm A issues a zero-coupon bond with a face value of $100,000 at the beginning of the

Just questions D and E please

Just questions D and E please

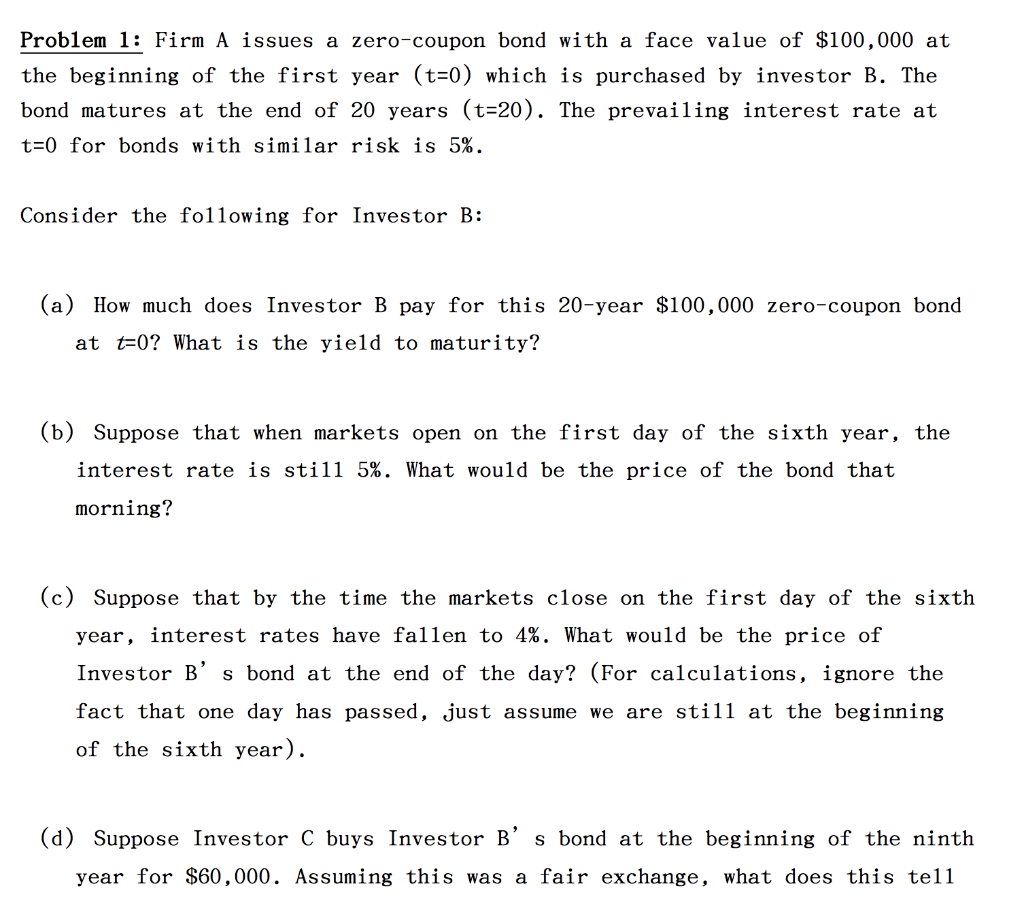

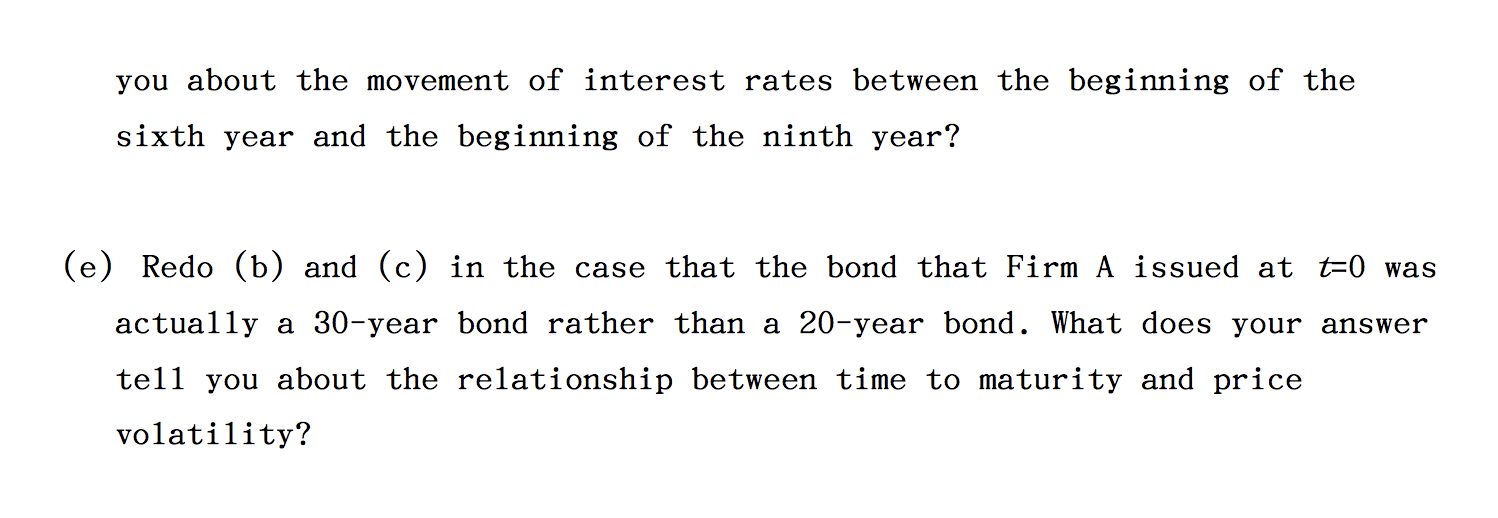

Problem 1: Firm A issues a zero-coupon bond with a face value of $100,000 at the beginning of the first year (t=0) which is purchased by investor B. The bond matures at the end of 20 years (t=20). The prevailing interest rate at t=0 for bonds with similar risk is 5%. Consider the following for Investor B: (a) How much does Investor B pay for this 20-year $100,000 zero-coupon bond at t=0? What is the yield to maturity? (b) Suppose that when markets open on the first day of the sixth year, the interest rate is still 5%. What would be the price of the bond that morning? (c) Suppose that by the time the markets close on the first day of the sixth year, interest rates have fallen to 4%. What would be the price of Investor B's bond at the end of the day? (For calculations, ignore the fact that one day has passed, just assume we are still at the beginning of the sixth year). (d) Suppose Investor C buys Investor Bs bond at the beginning of the ninth year for $60,000. Assuming this was a fair exchange, what does this tell you about the movement of interest rates between the beginning of the sixth year and the beginning of the ninth year? (e) Redo (b) and (c) in the case that the bond that Firm A issued at t=0 was actually a 30-year bond rather than a 20-year bond. What does your answer tell you about the relationship between time to maturity and price volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts