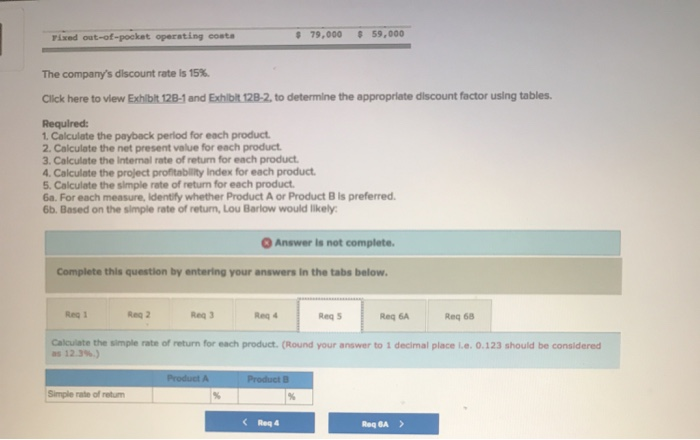

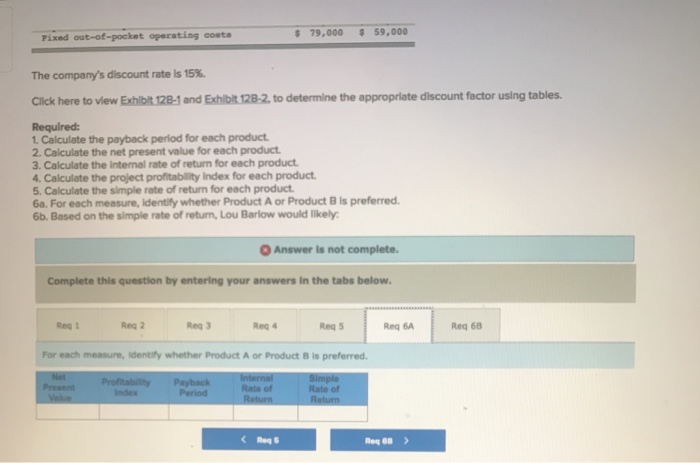

Question: Just required 4, 5, and 6a Problem 12-23 Comprehensive Problem L012-1, LO12-2, LO12-3, LO12-5, L012-6 Lou Barlow, a divisional manager for Sage Company, has an

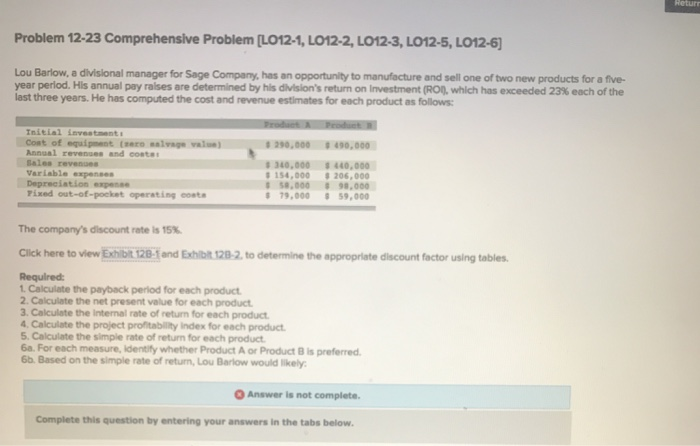

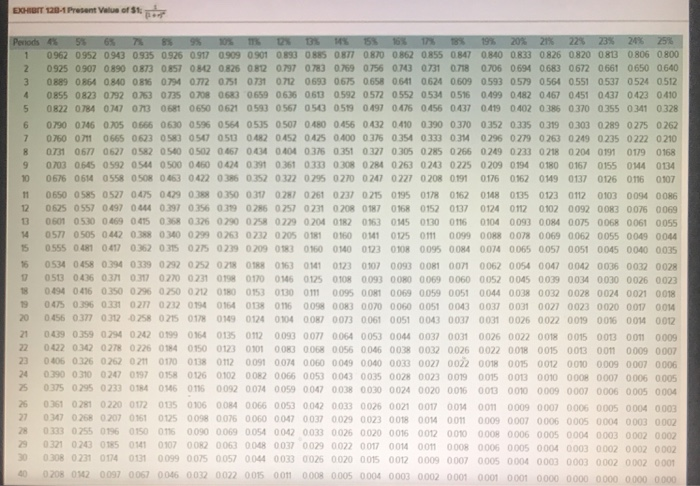

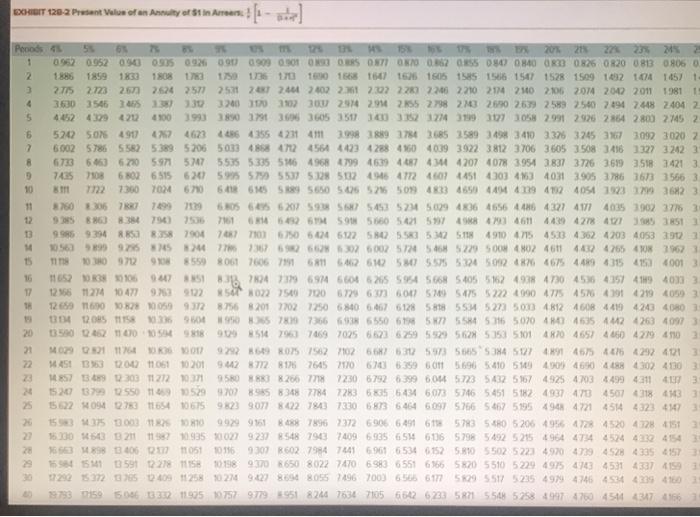

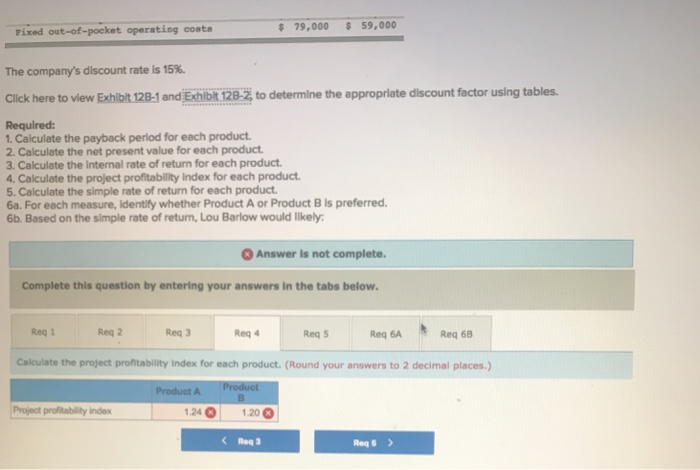

Problem 12-23 Comprehensive Problem L012-1, LO12-2, LO12-3, LO12-5, L012-6 Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his dMsion's return on Investment (R00, which has exceeded 23% each of the last three years. He has computed the cost and revenue estimates for each product as follows Tnitial ievestment Cont of equipment ( Annual revenues and costas (sero salvage valu 290,000 490,000 #340,000 g 440,0001 ; 154,000 $ 206,000 58,000 9.000 79,00059,000 Varlab1e Pixed out-of-pocket operating coate The company's discount rate is 15% Click here to view Exhibit 128-f and Exhiblt 128-2, to determine the appropriate discount factor using tables Required 1. Calculate the payback perlod for each product 2. Calculate the net present value for each product . Calculate the internal rate of return for each product Calculate the project profitabilility Index for each product 5. Calculate the simple rate of return for each product 6a. For each measure, identify whether Product A or Product B is preferred 6b. Based on the simple rate of returm, Lou Barlow would likely O Answer is not complete. Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts