Question: Just requirement 2 please A19-12 IFRS-Defined Benefit Plan; Three Elements: Faste Ltd. has a defined benefit pension plan. The following information relates to this plan:

Just requirement 2 please

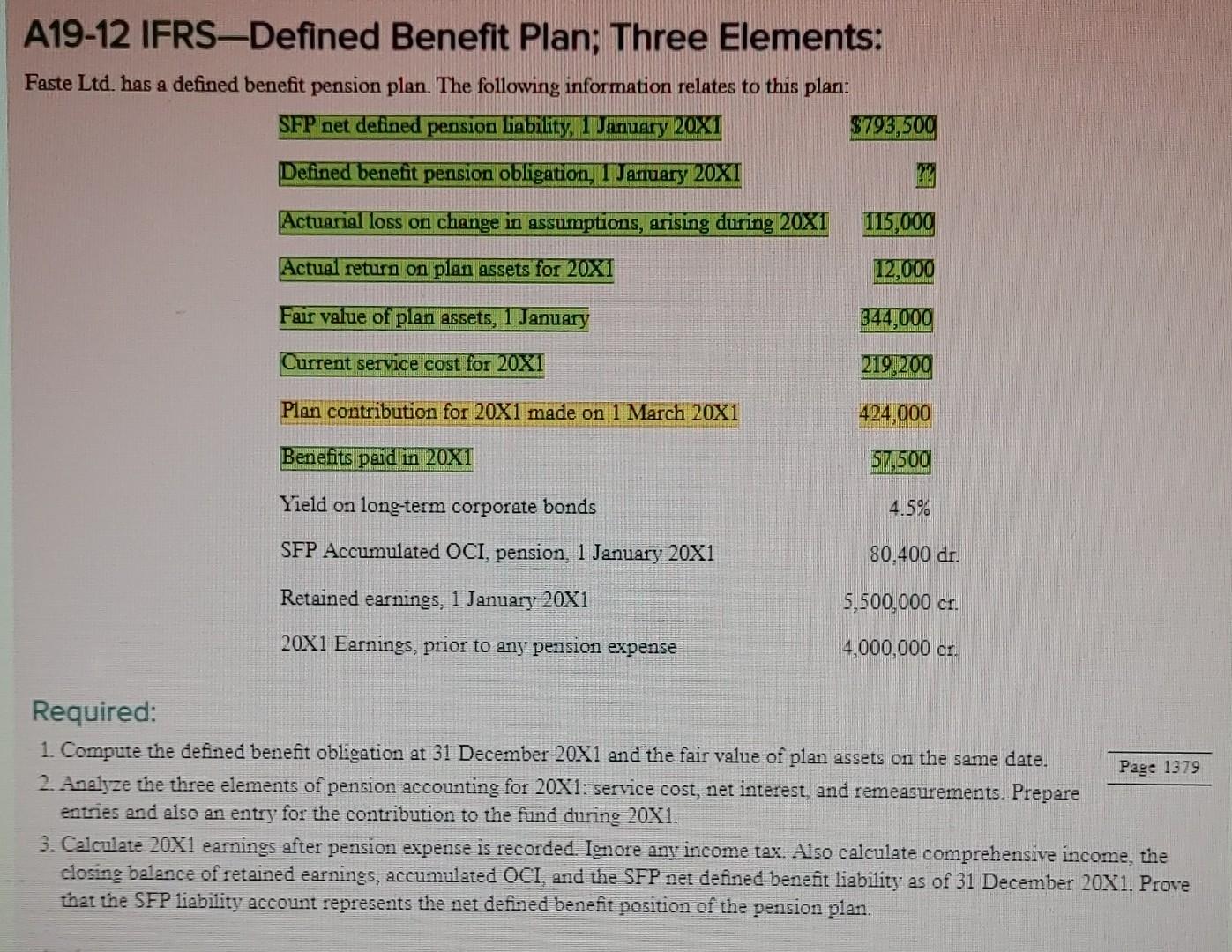

A19-12 IFRS-Defined Benefit Plan; Three Elements: Faste Ltd. has a defined benefit pension plan. The following information relates to this plan: SFP net defined pension Liability, Ianuary 20X1 $793,500 Defined benefit pension obligation, 1 January 20X1 Actuarial loss on change in assumptions, arising during 20X1 115,000 Actual return on plan assets for 20X1 12,000 Fair value of plan assets, 1 January 344,000 Current service cost for 20X1 219,200 Plan contribution for 20X1 made on 1 March 20X1 424,000 Benefits paid in 20X1 57,500 Yield on long-term corporate bonds 4.5% SFP Accumulated OCI, pension, 1 January 20X1 80,400 dr. Retained earnings, 1 January 20X1 5,500,000 cr. 20X1 Earnings, prior to any pension expense 4,000,000 cr. Required: 1. Compute the defined benefit obligation at 31 December 20X1 and the fair value of plan assets on the same date. Page 1379 2. Analyze the three elements of pension accounting for 20X1: service cost, net interest, and remeasurements. Prepare entries and also an entry for the contribution to the fund during 20X1. 3. Calculate 20X1 earnings after pension expense is recorded. Ignore any income tax. Also calculate comprehensive income, the closing balance of retained earnings, accumulated OCI, and the SFP net defined benefit liability as of 31 December 20X1. Prove that the SFP liability account represents the net defined benefit position of the pension plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts