Question: Just Show calculation using any equation The Project will entail an Engineering Economy study of evaluating whether to buy a house in your local area

Just Show calculation using any equation

Just Show calculation using any equation

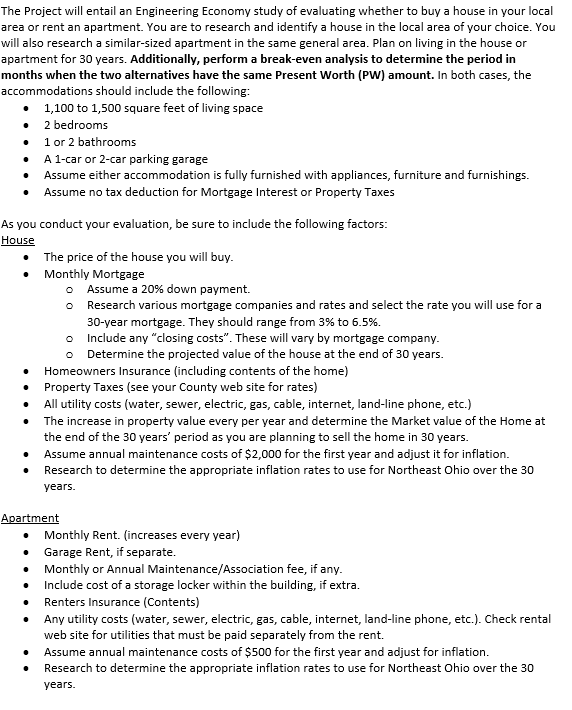

The Project will entail an Engineering Economy study of evaluating whether to buy a house in your local area or rent an apartment. You are to research and identify a house in the local area of your choice. You will also research a similar-sized apartment in the same general area. Plan on living in the house or apartment for 30 years. Additionally, perform a break-even analysis to determine the period in months when the two alternatives have the same Present Worth (PW) amount. In both cases, the accommodations should include the following: 1,100 to 1,500 square feet of living space 2 bedrooms 1 or 2 bathrooms A 1-car or 2-car parking garage Assume either accommodation is fully furnished with appliances, furniture and furnishings. Assume no tax deduction for Mortgage Interest or Property Taxes As you conduct your evaluation, be sure to include the following factors: House The price of the house you will buy. Monthly Mortgage o Assume a 20% down payment. Research various mortgage companies and rates and select the rate you will use for a 30-year mortgage. They should range from 3% to 6.5%. o Include any "closing costs". These will vary by mortgage company. o Determine the projected value of the house at the end of 30 years. Homeowners Insurance (including contents of the home) Property Taxes (see your County web site for rates) All utility costs (water, sewer, electric, gas, cable, internet, land-line phone, etc.) The increase in property value every per year and determine the Market value of the Home at the end of the 30 years' period as you are ing to sell the home in 30 years. Assume annual maintenance costs of $2,000 for the first year and adjust it for inflation. Research to determine the appropriate inflation rates to use for Northeast Ohio over the 30 years. Apartment Monthly Rent (increases every year) Garage Rent, if separate. Monthly or Annual Maintenance/Association fee, if any. Include cost of a storage locker within the building, if extra. Renters Insurance Contents) Any utility costs (water, sewer, electric, gas, cable, internet, land-line phone, etc.). Check rental web site for utilities that must be paid separately from the rent. Assume annual maintenance costs of $500 for the first year and adjust for inflation. Research to determine the appropriate inflation rates to use for Northeast Ohio over the 30 years. The Project will entail an Engineering Economy study of evaluating whether to buy a house in your local area or rent an apartment. You are to research and identify a house in the local area of your choice. You will also research a similar-sized apartment in the same general area. Plan on living in the house or apartment for 30 years. Additionally, perform a break-even analysis to determine the period in months when the two alternatives have the same Present Worth (PW) amount. In both cases, the accommodations should include the following: 1,100 to 1,500 square feet of living space 2 bedrooms 1 or 2 bathrooms A 1-car or 2-car parking garage Assume either accommodation is fully furnished with appliances, furniture and furnishings. Assume no tax deduction for Mortgage Interest or Property Taxes As you conduct your evaluation, be sure to include the following factors: House The price of the house you will buy. Monthly Mortgage o Assume a 20% down payment. Research various mortgage companies and rates and select the rate you will use for a 30-year mortgage. They should range from 3% to 6.5%. o Include any "closing costs". These will vary by mortgage company. o Determine the projected value of the house at the end of 30 years. Homeowners Insurance (including contents of the home) Property Taxes (see your County web site for rates) All utility costs (water, sewer, electric, gas, cable, internet, land-line phone, etc.) The increase in property value every per year and determine the Market value of the Home at the end of the 30 years' period as you are ing to sell the home in 30 years. Assume annual maintenance costs of $2,000 for the first year and adjust it for inflation. Research to determine the appropriate inflation rates to use for Northeast Ohio over the 30 years. Apartment Monthly Rent (increases every year) Garage Rent, if separate. Monthly or Annual Maintenance/Association fee, if any. Include cost of a storage locker within the building, if extra. Renters Insurance Contents) Any utility costs (water, sewer, electric, gas, cable, internet, land-line phone, etc.). Check rental web site for utilities that must be paid separately from the rent. Assume annual maintenance costs of $500 for the first year and adjust for inflation. Research to determine the appropriate inflation rates to use for Northeast Ohio over the 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts