Question: just solve 4-7A based on 4-6A question Problem 4-6A Closing entries LO2, 3 The adjusted trial balance for Lloyd Construction as of December 31, 2020,

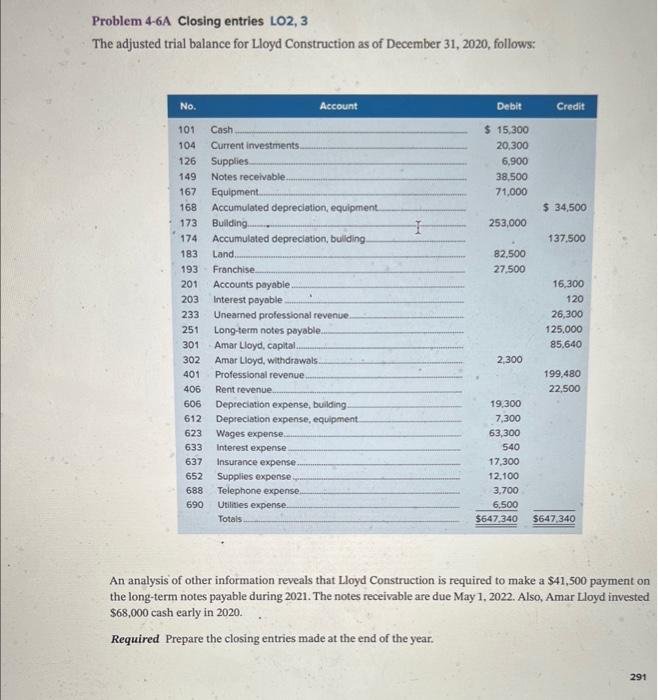

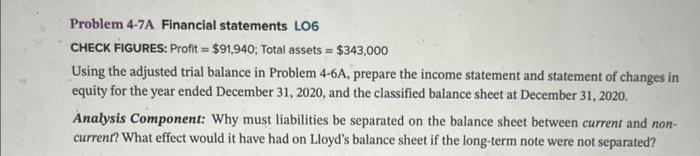

Problem 4-6A Closing entries LO2, 3 The adjusted trial balance for Lloyd Construction as of December 31, 2020, follows: An analysis of other information reveals that Lloyd Construction is required to make a $41,500 payment on the long-term notes payable during 2021. The notes receivable are due May 1, 2022. Also, Amar Lloyd invested $68,000 cash early in 2020. Required Prepare the closing entries made at the end of the year. Problem 4-7A. Financial statements LO6 CHECK FIGURES: Profit =$91,940; Total assets =$343,000 Using the adjusted trial balance in Problem 4-6A, prepare the income statement and statement of changes in equity for the year ended December 31,2020 , and the classified balance sheet at December 31,2020 . Analysis Component: Why must liabilities be separated on the balance sheet between current and noncurrent? What effect would it have had on Lloyd's balance sheet if the long-term note were not separated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts