Question: Just the last question pls Current Attempt in Progress Bramble Hoadley and Debra Quayle borrowed $22,800 on a 7-month, 9% bank loan from BMO Bank

Just the last question pls

Just the last question pls

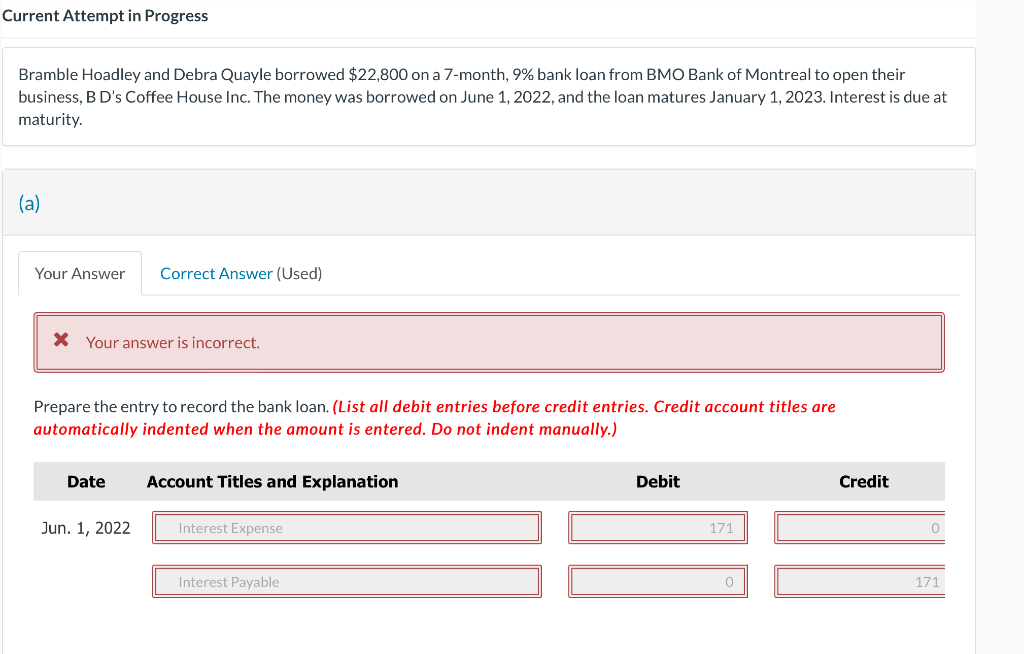

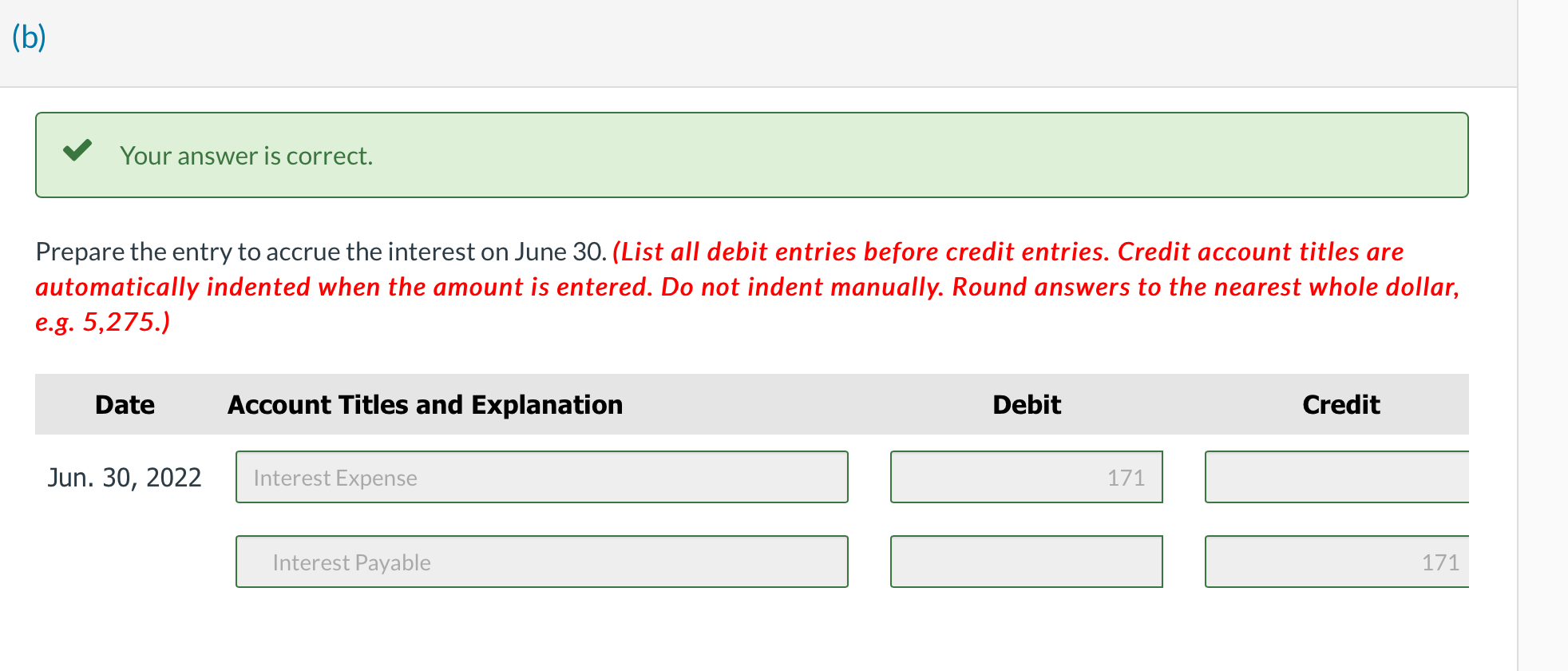

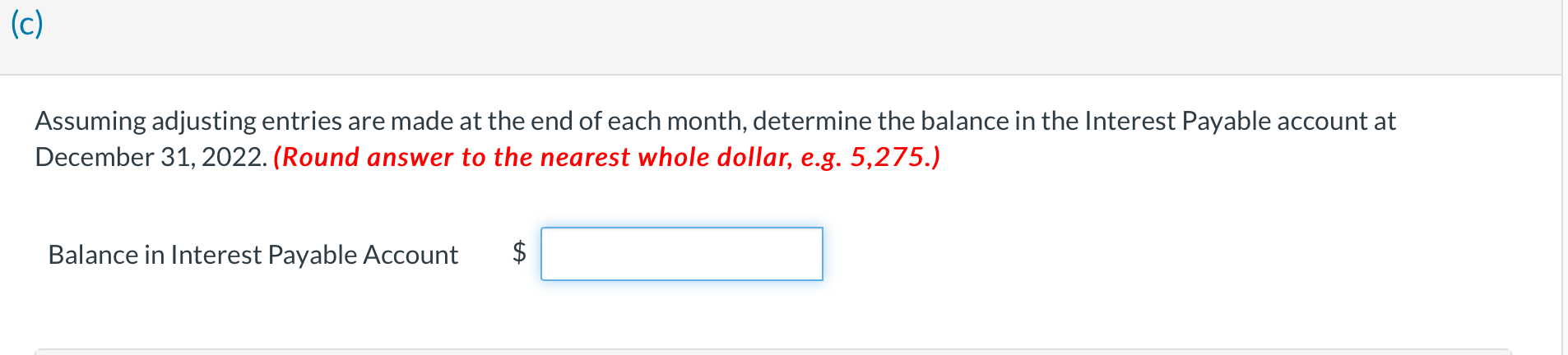

Current Attempt in Progress Bramble Hoadley and Debra Quayle borrowed \$22,800 on a 7-month, 9\% bank loan from BMO Bank of Montreal to open their business, B D's Coffee House Inc. The money was borrowed on June 1, 2022, and the loan matures January 1, 2023. Interest is due at maturity. (a) Prepare the entry to record the bank loan. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Prepare the entry to accrue the interest on June 30. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to the nearest whole dollar, e.g. 5,275.) Assuming adjusting entries are made at the end of each month, determine the balance in the Interest Payable account at December 31, 2022. (Round answer to the nearest whole dollar, e.g. 5,275.) Balance in Interest Payable Account $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts