Question: just these 2 1. A $1,000 face value bond has a coupon rate of 7 percent, a market price of $989.40, and 10 years left

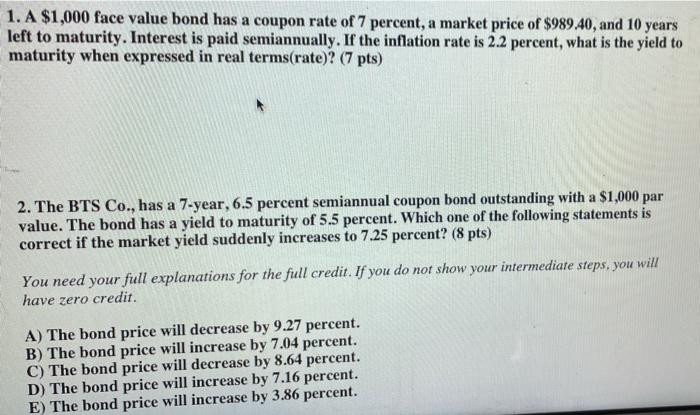

1. A $1,000 face value bond has a coupon rate of 7 percent, a market price of $989.40, and 10 years left to maturity. Interest is paid semiannually. If the inflation rate is 2.2 percent, what is the yield to maturity when expressed in real terms(rate)? (7 pts) 2. The BTS Co., has a 7-year, 6.5 percent semiannual coupon bond outstanding with a $1,000 par value. The bond has a yield to maturity of 5.5 percent. Which one of the following statements is correct if the market yield suddenly increases to 7.25 percent? (8 pts) You need your full explanations for the full credit. If you do not show your intermediate steps, you will have zero credit. A) The bond price will decrease by 9.27 percent. B) The bond price will increase by 7.04 percent. C) The bond price will decrease by 8.64 percent. D) The bond price will increase by 7.16 percent. E) The bond price will increase by 3.86 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts