Question: Just write T or F. Pls answer all asap. 1. Reol is the excess of reported NOPAT over what we expected NOPAT to be given

Just write T or F. Pls answer all asap.

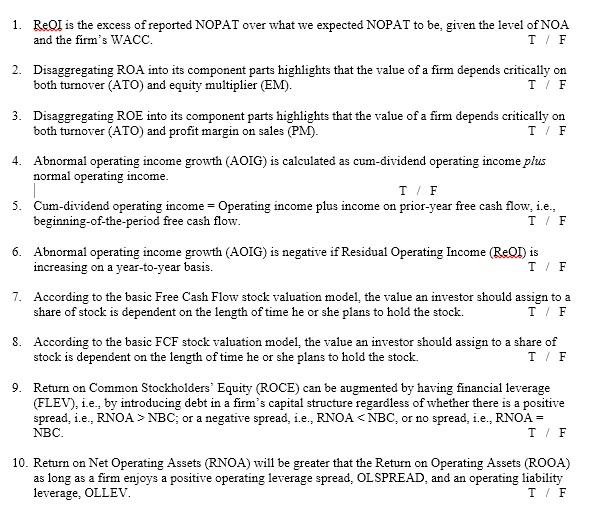

1. Reol is the excess of reported NOPAT over what we expected NOPAT to be given the level of NOA and the firm's WACC. T/F 2. Disaggregating ROA into its component parts highlights that the value of a firm depends critically on both turnover (ATO) and equity multiplier (EM). T/F 3. Disaggregating ROE into its component parts highlights that the value of a firm depends critically on both turnover (ATO) and profit margin on sales (PM). TIF 4. Abnormal operating income growth (AOIG) is calculated as cum-dividend operating income plus normal operating income. T/F 5. Cum-dividend operating income = Operating income plus income on prior-year free cash flow, i.e., beginning-of-the-period free cash flow. T/F 6. Abnormal operating income growth (AOIG) is negative if Residual Operating Income (ReQD) is increasing on a year-to-year basis. T/F 7. According to the basic Free Cash Flow stock valuation model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. T/F 8. According to the basic FCF stock valuation model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. T/F 9. Return on Common Stockholders' Equity (ROCE) can be augmented by having financial leverage (FLEV), i.e., by introducing debt in a firm's capital structure regardless of whether there is a positive spread, i.e., RNOA > NBC, or a negative spread, i.e., RNOA CNBC, or no spread, i.e., RNOA = / F NBC 10. Return on Net Operating Assets (RNOA) will be greater that the Return on Operating Assets (ROOA) as long as a firm enjoys a positive operating leverage spread. OL SPREAD, and an operating liability leverage, OLLEV. T/F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts