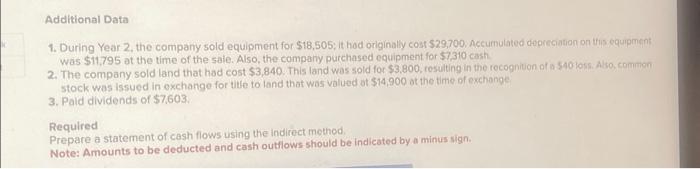

Question: k Additional Data 1. During Year 2, the company sold equipment for $18,505; it had originally cost $29,700. Accumulated depreciation on this equipment was $11,795

Additional Data 1. During Year 2, the company sold equipment for $18,505; it hod originally cost $29,700. Accumulated cepreciation on itis equipment was $11,795 at the time of the sale. Also, the company purchased equipment for $7,310 cast 2. The company sold land that had cost $3,840. This land was sold for $3,800, rosulting in the recognition of in $40 lons. Alsa, camiton stock was issued in exchange for tite to land that wos valued at $14,900 ot the time of exchange 3. Pald dividends of $7,603. Requlred Prepare a statement of cash flows using the indirect method Note: Amounts to be deducted and cash outfiows should be indicated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts