Question: K Assessment 3 Case Study Data Background Amity Holdings Pty Limited (Amity) is an Australian resident company that was incorporated during 2022. After purchasing several

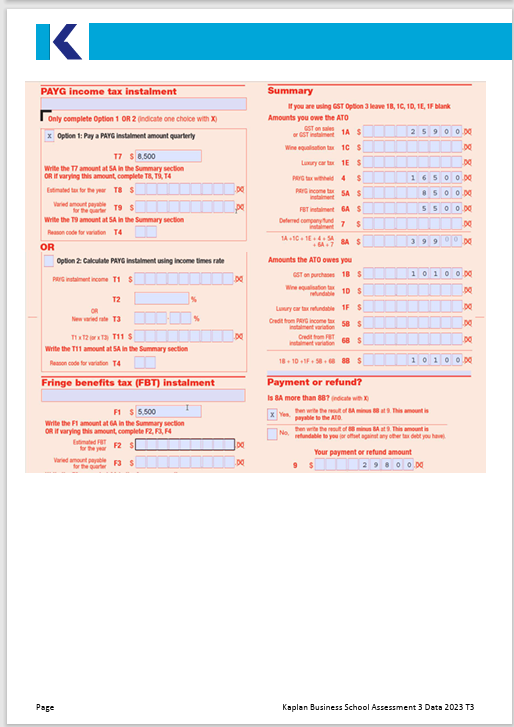

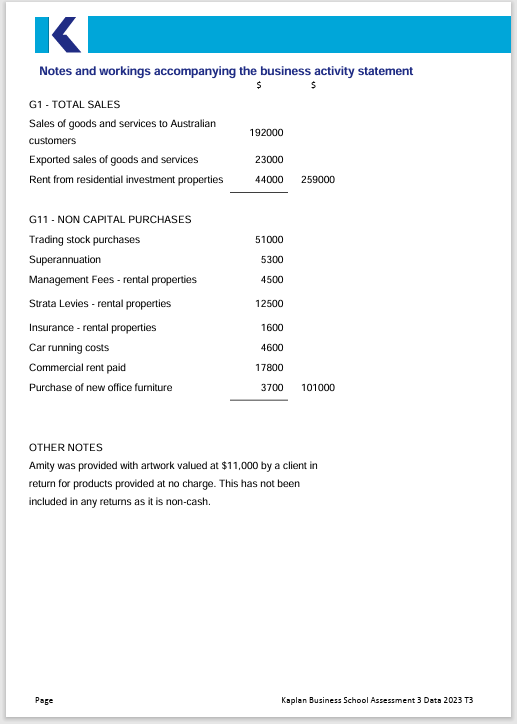

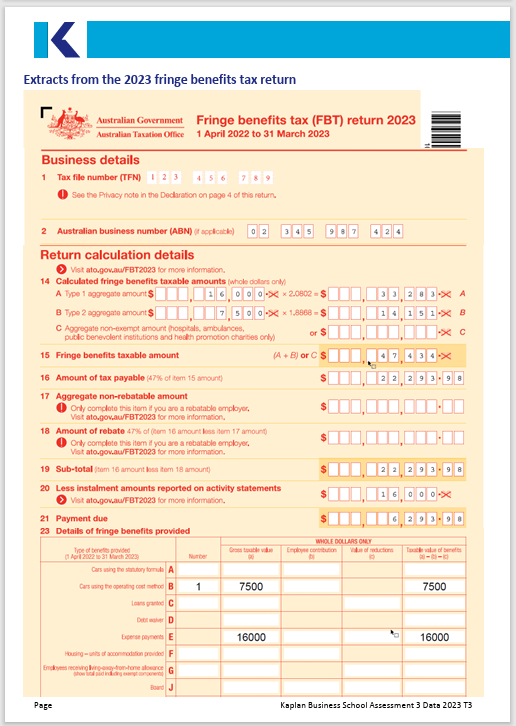

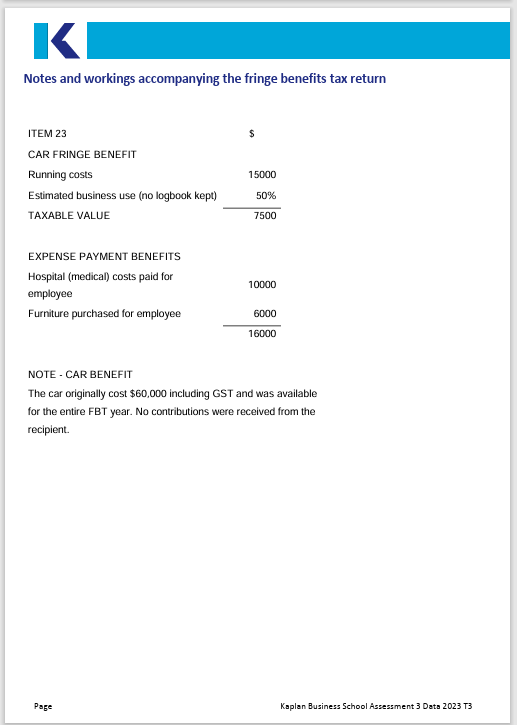

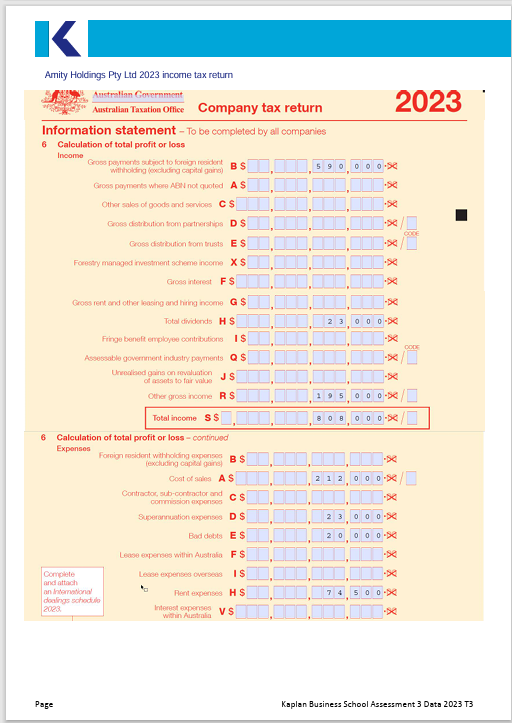

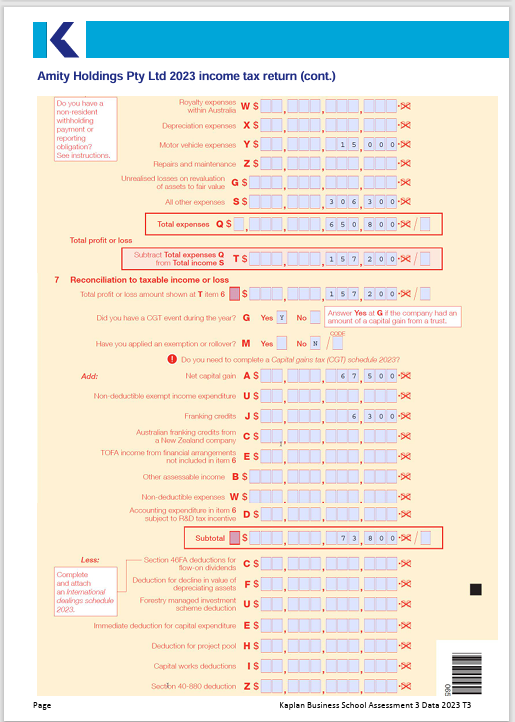

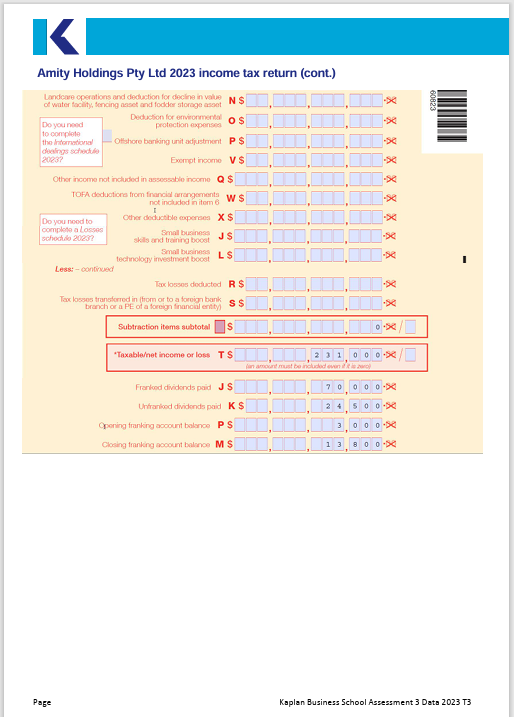

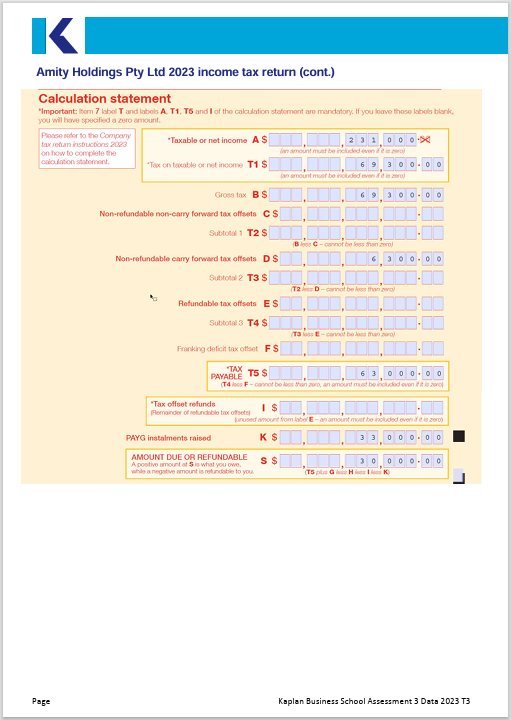

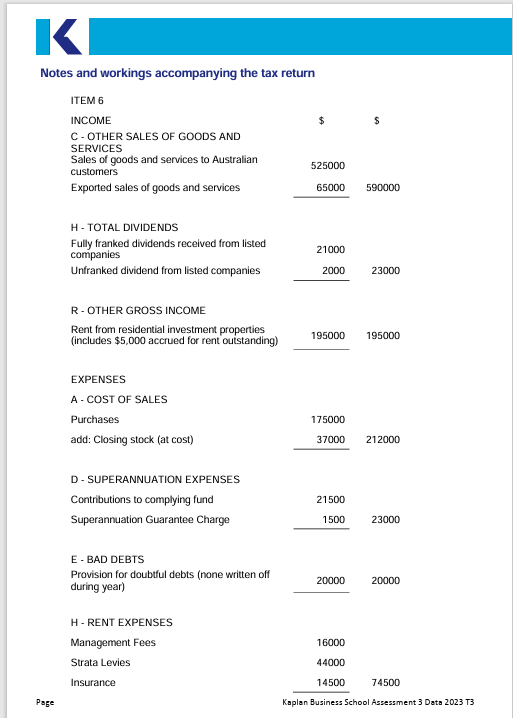

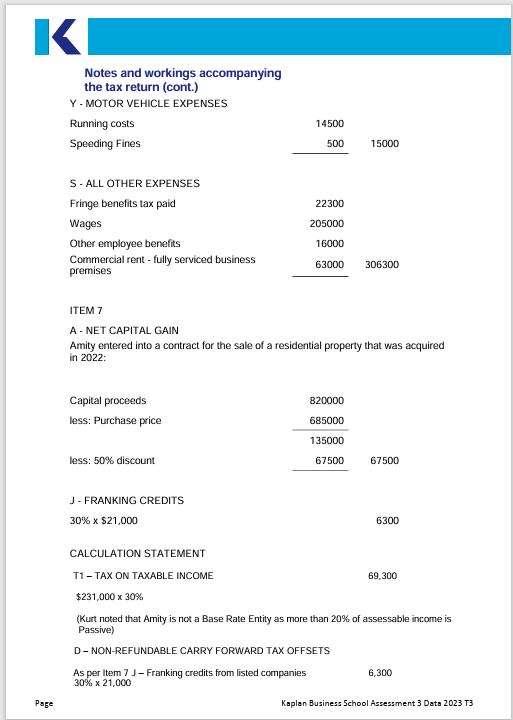

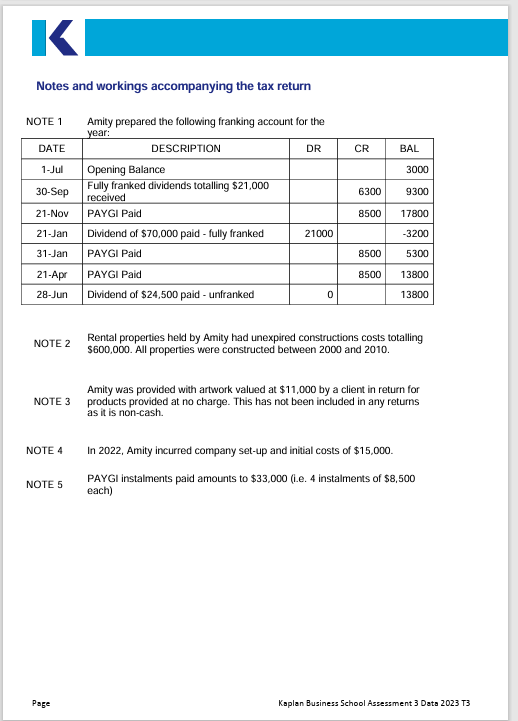

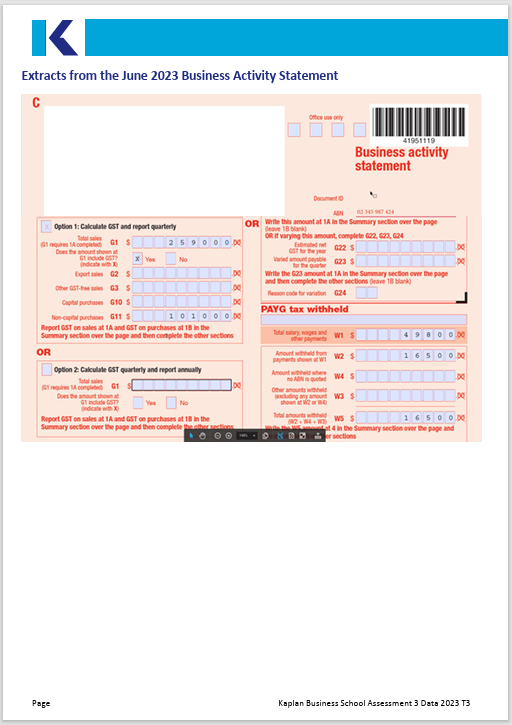

K Assessment 3 Case Study Data Background Amity Holdings Pty Limited (Amity) is an Australian resident company that was incorporated during 2022. After purchasing several investments including real estate and shares, in 2023 Amity commenced business as a golf equipment wholesaler with both Australian and overseas clients. Katy Mahon, the Managing Director of Amity, has terminated Kurt Aild, the company's accountant, as she is concerned that there are several errors in the returns prepared. Katy has provided the following information produced by Kurt: a) 2023 Income Tax Return b) Additional notes accompanying the income tax return including franking account c) June 2023 Business Activity Statement (BAS) d) Additional notes accompanying the BAS e) 2023 Fringe Benefits Tax Return () Notes and workings accompanying the FBT return Requirements Katy has requested that you prepare a statement of advice including: D Any necessary corrections to Amity's Income Tax Return that impacts taxable income, income tax liability or the franking account. Each correction should be supported by a brief explanation and correct referencing from legislation, along with any workings and calculations. Any necessary corrections to Amity's Fringe Benefits Tax Return that impacts the taxable value of benefits and fringe benefits tax liability. Each correction should be supported by a brief explanation and correct referencing from legislation, along with any workings and calculations. Any necessary corrections to Amity's Business Activity Statement that impacts GST on sales, GST on purchases and net GST payable. Each correction should be supported by a brief explanation and correct referencing from legislation, along with any workings and calculations. Page Kaplan Business School Assessment 3 Data 2023 73K PAYG income tax instalment Summary you are wiling GST Option ] home 10, 16, 10, 14, IF Blank Only complete Option 1 OR 2 (indicate one choice with X) Amounts you owe the ATO * Option 1: Pay a PAYG Instalment amount quarterly 25 90 0.0 17 $ 8,500 Write the IT amount at SA In the Summary section OR if varying this amount, complete TA, Ti 14 1 6 5 0 0.0q 6 5 0 0.Dq TO $ 5 5 0 0.00 Write the To amount at 5A In the Summary section T pq Pleawon code for variation T4 3 9 9 90 0q OR Option 2: Calculate PAYS Intelment ining Income times rate Amounts the ATO owes you 10 5 1010 0 5 10 5 T2 IF S New woried rate TJ instalment variation NIKITA TH1 $ 68 5 Write the Til amount at 5A In the Summary wellon Andcon code for varaken T4 1+ 10 . + + 08 88 Fringe benefits tax (FBT] Instalment Payment or refund? In BA more than CAT Inden wap F1 $ 5.500 Write the FI amount at GA in the Summary Lection OR if varying this amount, complete 12, 13, M Na, Your payment of refund amount .pg Page Kaplan Business School Assessment 3 Data 2023 73K Notes and workings accompanying the business activity statement $ $ G1 - TOTAL SALES Sales of goods and services to Australian 192000 customers Exported sales of goods and services 23000 Rent from residential investment properties 44000 259000 G11 - NON CAPITAL PURCHASES Trading stock purchases 51000 Superannuateon 5300 Management Fees - rental properties 4500 Strata Levies - rental properties 12500 Insurance - rental properties 1600 Car running costs 4600 Commercial rent paid 17800 Purchase of new office furniture 3700 101000 OTHER NOTES Amity was provided with artwork valued at $11,000 by a client in return for products provided at no charge. This has not been included in any returns as it is non-cash. Page Kaplan Business School Assessment 3 Data 2023 13Extracts from the 2023 fringe benefits tax return Australian Government Fringe benefits tax (FBT) return 2023 Australian Taxation Office 1 April 2022 to 31 March 2023 Business details Tax file number (TFN) 1 2 3 4 5 6 7 8 9 () Sea the Privacy note in the Declaration on page 4 of this return. 2 Australian business number (ABN) of applicatic) 0 2 3 4 5 9 8 7 4 24 Return calculation details Visit ato.gov.au/FBT2023 for more information. 14 Calculated fringe benefits taxable amounts (whole dollars only) A Type 1 aggregate amount $ 16 0 6 0-> x 20802 - $ |3 3 2 8 3x A B Type 2 aggregate amount $ |7 5 0 0-3 x 18060 - $| |14 1 5 1% 8 C Aggregate non-exempt amount (hospitals, ambulances, public benevolent institutions and health promotion charities only) or $ x c 15 Fringe benefits taxable amount (A + BorCS |47 4 34% 16 Amount of tax payable (471 of item 15 amount) 17 Aggregate non-rebatable amount !) Only complete this itom if you are a robatable employor, Visit ato.gov.aw/FBT2023 for more information. 18 Amount of rebate 47% of (som 16 amount loss item 17 amount) 0) Only complete this itor if you are a rubatable employer Visit ato.gov.nw/FBT2023 for more information. 19 Sub-total (tom 16 amount loss (tom 18 amount) $ 2 2 2 9 3 98 20 Less instalment amounts reported on activity statements (3 Visit ato.gov.au/FBT2023 for more information. 21 Payment due 23 Details of fringe benefits provided WHOLE DOLLARS CHAT Employee contribution Value of reduction ( April 2002 10 31 March 2023 Cars word for quality cat food B 7500 7500 16000 16000 Employees receiving living-sory forthe flowate Baird Page Kaplan Business School Assessment 3 Data 2023 13Notes and workings accompanying the fringe benefits tax return ITEM 23 CAR FRINGE BENEFIT Running costs 15000 Estimated business use (no logbook kept) 50% TAXABLE VALUE 7500 EXPENSE PAYMENT BENEFITS Hospital (medical) costs paid for 10000 employee Furniture purchased for employee 6000 16000 NOTE - CAR BENEFIT The car originally cost $60,000 including GST and was available for the entire FBT year. No contributions were received from the recipient. Page Kaplan Business School Assessment 3 Data 2023 13KI Amity Holdings Pty Lid 2023 income tax return Australian Government Australian Taxation Office Company tax return 2023 Information statement - To be completed by all companies 6 Calculation of total profit or loss Income Grows payments butpul to foreign nesdont withhoking foxd kong capital gains) BS 590 0 0 0.50 Garces payments where ABN not quoted A S Other sale of goods and services C $ Gross detribution from partnerships D S Gross distribution from tres E S Forestry managed investment scheme income X S Gross interest F S Gross rent and other basing and haing income G S Total dividends H S 2 3 0 0 0-50 Fringe benefit employee contributions IS Assessable government industry payments Q S Ureondaed gains on anvaluation of macota to for with JS -Be Other gross income R S Total income $ 5 6 Calculation of total profit or loss - continued Expanses Fomign moskdont withholding exponana (excluding capital guired B S Coat of aning A S 2 1 2 0 0 0-50 Contractor, sub-contractor and CS Supernation expense D S 2 3 0 0 0-3 Bad debts E S 20 0 0 0- Leave caperises within Austrain F S -Be Compile IS -Be and attach Peril experia H $ 7 4 5 0 0-3 2023 Interest coperises Within Aurimba VS Page Kaplan Business School Assessment 3 Data 2023 73K Amity Holdings Pty Ltd 2023 income tax return (cont.) Do you have a Royally exponous w s non -resickril within Australia withhodding perymont or Depreciation expenses X S obligations Motor vehicle expenses Y S 1 5 0 0 030 See instructiona. Repairs and maintenance Z 'S Unrealised lcases on revaluation of nasets to fair value GS All other expenses S S 306 3 0 0-30 Total expenses Q S 6 5 0 8 0 0-50 Total profit or loss Subtract Total expenses Q from Total income S TS 1 5 7 2 0 0-50 7 Reconciliation to taxable income or loss Total profit or loss amount shown at T item & |$ 1 5 7 2 0 0-50 Did you have a OUT event during the year? G Yes Y No Areewer Yes at G if the company had an amount of a capital gain from a trust. Have you applied an exemption or rolover? M Yes No N O Do you need to complete a Capital gains tor (OGI) schede 20237 Add: Net capital gain A S Non-deductible exemplincome expenditure US Franking Crudes J S 6 3 0 030 Australian franking Grodits from a Now goaland company CS TOFA Income from financial sergements not included in ifom & E S Other sidetable income B S Non-deductible expenses W S Accounting expandourro in itom & subjool to RED tax incentivg 'DS Subtotal S 7 3 8 0 050 Section 46FA deductions for how on dividenda CS Complete and attach Deduction for docino in value of F S Forestry managed investment achome deduction US Immediate deduction for coptal expenditure ES Deduction ter project pool H S Coptal works doductions IS Section 40-800 doduction Z S Page Kaplan Business School Assessment 3 Data 2023 13K Amity Holdings Pty Ltd 2023 income tax return (cont.) Landcare operations and deduction for decline in value of water facility, toncing naset and fodder aforage aspot IN S Deduction for environmental Do you rand protection expose O$ -se to complete the Interruptional Offshore banking unit adjustment P $ Exempt income VS Other income not included in assessable income Q $ 1OF deductiona from financial arrangements XXXXXXX not included in itom 6 WS Do you nood to Other deductible mperson X $ complete a Losses Small business skis and brainng bocal JS technokary investment bocal LS Tax losses doducted R S Tax lossos transformed in (from or to a foreign bank branch of a PE of a foreign financial entity] SS . De Subtraction items subtotal |s "Taxableet income or loss T S 23 1 0 0 05/ Frankand dividends paid J S Unfranked dividends paid K S 2 4 5 0 0-30 Opening franking account balance P S Closing franking account balance M S 1 3 80 0 Kaplan Business School Assessment 3 Data 2023 13K Amity Holdings Pty Ltd 2023 income tax return (cont.) Calculation statement "Important: Rom 7 label T and kabobs A. T1, TS and I of the calculation statement are mandatory If you leave those labels blank. you will have specified a zero amount. Pinon water to the Company "Taxable or net income A $ 2 3 1 0 0 050 on how to complete the only Anton statement. "Tax on taxable or net income T1 $ 6 9 3 0 0 - 0 0 Gross fox B $ 6 9 3 0 0 -0 0 Non-refundable non-carry forward tax offers C $ Subtotal 1 T2 $ Non-refundable carry forward tax offsets D $ 360.0 0 Subtotal 2 T3 $ Refundable tax offsets E $ Subtotal 3 T4 $ Franking defich tax offset FS "TAX PAYABLE 6 3 0 0 0 .0 0 (T4 kes F - cannot be kes then awo, an amount must be included even ? it as soned "Tax offset refunds Flemainder of refundable toy offsetey IS PAYG instalments raised K $ 3 3 0 0 0 .0 0 AMOUNT DUE OR REFUNDABLE A pootivo mount at 5 in what you owe. S $ while a nopelive amount is retardable to your Page Kaplan Business School Assessment 3 Data 2023 73K Notes and workings accompanying the tax return ITEM 6 INCOME C - OTHER SALES OF GOODS AND SERVICES Sales of goods and services to Australian 525000 customers Exported sales of goods and services 65000 590000 H - TOTAL DIVIDENDS Fully franked dividends received from listed companies 21000 Unfranked dividend from listed companies 2000 23000 R - OTHER GROSS INCOME Rent from residential investment properties includes $5,000 accrued for rent outstanding) 195000 195000 EXPENSES A - COST OF SALES Purchases 175000 add: Closing stock (at cost) 37000 212000 D - SUPERANNUATEN EXPENSES Contributions to complying fund 21500 Superannuateon Guarantee Charge 1500 23000 E - BAD DEBTS Provision for doubtful debts (none written off 20000 20000 during year) H - RENT EXPENSES Management Fees 16000 Strata Levies 44000 Insurance 14500 74500 Page Kaplan Business School Assessment 3 Data 2023 73K Notes and workings accompanying the tax return (cont.) Y - MOTOR VEHICLE EXPENSES Running costs 14500 Speeding Fines 500 15000 S - ALL OTHER EXPENSES Fringe benefits tax paid 22300 Wages 205000 Other employee benefits 16000 Commercial rent - fully serviced business 63000 306300 premises ITEM 7 A - NET CAPITAL GAIN Amity entered into a contract for the sale of a residential property that was acquired in 2022: Capital proceeds 820000 less: Purchase price 685000 135000 less: 50% discount 67500 67500 J - FRANKING CREDITS 30% x $21,000 6300 CALCULATION STATEMENT T1 - TAX ON TAXABLE INCOME 69,300 $231,000 x 30% Kurt noted that Amity is not a Base Rate Entity as more than 20% of assessable income is Passive) D - NON-REFUNDABLE CARRY FORWARD TAX OFFSETS As per Item 7 J - Franking credits from listed companies 6,300 30% x 21,000 Page Kaplan Business School Assessment 3 Data 2023 3K Notes and workings accompanying the tax return NOTE 1 Amity prepared the following franking account for the year: DATE DESCRIPTION DR CR BAL 1-Jul Opening Balance 3000 30-Sep Fully franked dividends totalling $21,000 6300 9300 received 21-Nov PAYGI Paid 8500 17800 21-Jan Dividend of $70,000 paid - fully franked 21000 -3200 31-Jan PAYGI Paid 8500 5300 21-Ap PAYGI Paid 8500 13800 28-Jun Dividend of $24,500 paid - unfranked 0 13800 NOTE 2 Rental properties held by Amity had unexpired constructions costs totalling $600,000. All properties were constructed between 2000 and 2010. Amity was provided with artwork valued at $11,000 by a client in return for NOTE 3 products provided at no charge. This has not been included in any returns as it is non-cash. NOTE 4 In 2022, Amity incurred company set-up and initial costs of $15,000. NOTE 5 PAYGI instalments paid amounts to $33,000 (i.e. 4 instalments of $8,500 each) Page Kaplan Business School Assessment 3 Data 2023 73K Extracts from the June 2023 Business Activity Statement C 100 41951119 Business activity statement x Option 1: Calculate GST and report quarterly OR Write this amount at IA In the Summary section over the page Of if varying this amount, complete (2, 6:3, 634 2590690 032 5 Varied amount popebin G23 $ Write the G23 amount at 14 in the Summary section over the page and boxin complete the offer wellon (have 10 blanky G34 PAYG tax withheld Whom capital purchase G11 $ 1010 095 Report GST on sales at 1A and GST on purchases at 15 In the Summary section over the page and then complete the other sections WI $ 4 9 8 0 050 OR W2 $ 1 6 5095 Option 2: Calculate GST quarterly and report annually WA S Total wing Appart CUT on sales of 1A and CUT on purchong at 15 In the W3 S 1650 05 Summary Meeton our the page and then complete the after an for at 4 in the Summary Action over To page and Kaplan Business School Assessment 3 Data 2023 73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts