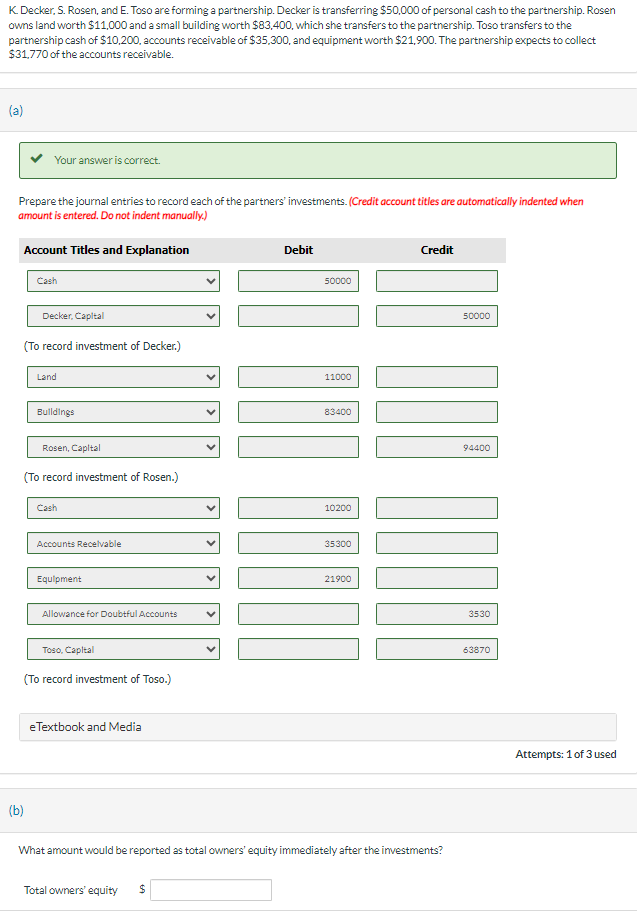

Question: K . Decker, S . Rosen, and E . Toso are forming a partnership. Decker is transferring $ 5 0 , 0 0 0 of

K Decker, S Rosen, and E Toso are forming a partnership. Decker is transferring $ of personal cash to the partnership. Rosen

owns land worth $ and a small building worth $ which she transfers to the partnership. Toso transfers to the

partnership cash of $ accounts receivable of $ and equipment worth $ The partnership expects to collect

$ of the accounts receivable.

a

Your answer is correct.

Prepare the joumal entries to record each of the partners' investments. Credit account titles are automatically indented when

amount is entered. Do not indent manually.

Account Titles and Explanation

Debit

Credit

Cash

Decker, Capltal

To record investment of Decker.

Land

Bulldings

Rosen, Capltal

To record investment of Rosen.

Cash

Accounts Recelvable

Equlpment

Allowance for Doubtful Accounts

Toso, Capltal

To record investment of Toso.

eTextbook and Media

b

What amount would be reported as total owners' equity immediately after the imvestments?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock