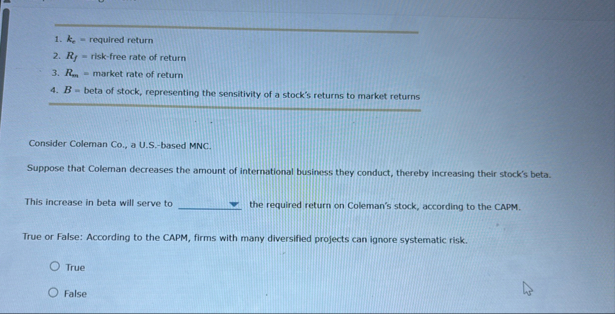

Question: k e = required return R f = risk - free rate of return R m = market rate of return B = beta of

required return

riskfree rate of return

market rate of return

beta of stock, representing the sensitivity of a stock's returns to market returns

Consider Coleman Co a USbased MNC

Suppose that Coleman decreases the amount of international business they conduct, thereby increasing their stock's beta.

This increase in beta will serve to the required return on Coleman's stock, according to the CAPM.

True or False: According to the CAPM, firms with many diversified projects can ignore systematic risk.

True

False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock