Question: k Exercise 194 Your answer is partially correct. Try again. Harris Timber Corporation uses a machine that removes the bark from cut timber. The machine

k

k

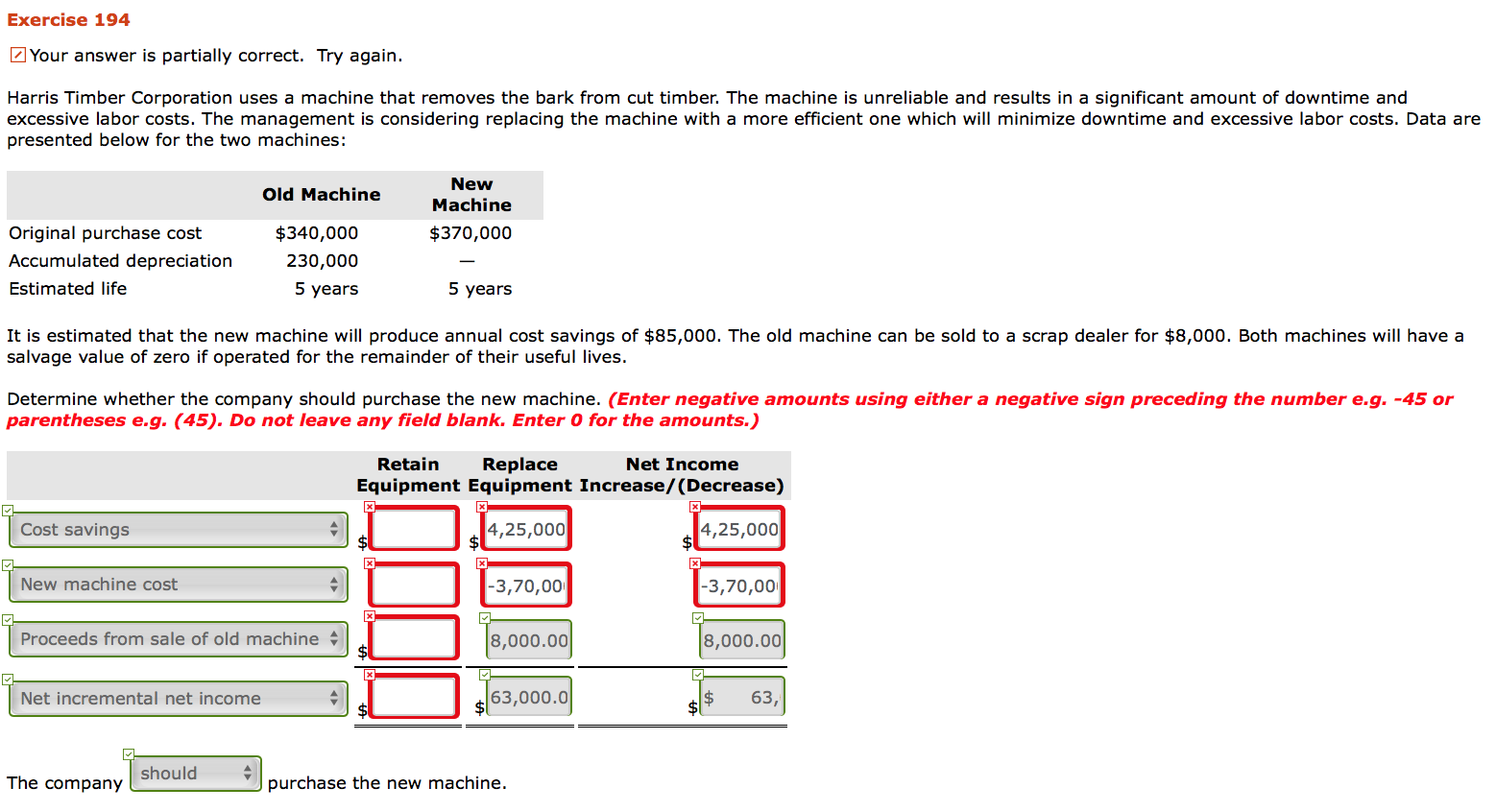

Exercise 194 Your answer is partially correct. Try again. Harris Timber Corporation uses a machine that removes the bark from cut timber. The machine is unreliable and results in a significant amount of downtime and excessive labor costs. The management is considering replacing the machine with a more efficient one which will minimize downtime and excessive labor costs. Data are presented below for the two machines: Old Machine New Machine $370,000 Original purchase cost Accumulated depreciation Estimated life $340,000 230,000 5 years 5 years It is estimated that the new machine will produce annual cost savings of $85,000. The old machine can be sold to a scrap dealer for $8,000. Both machines will have a salvage value of zero if operated for the remainder of their useful lives. Determine whether the company should purchase the new machine. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Do not leave any field blank. Enter o for the amounts.) Retain Replace Net Income Equipment Equipment Increase/(Decrease) Cost savings 4,25,000 4,25,000 New machine cost -3,70,00 -3,70,00 Proceeds from sale of old machine 8,000.00 8,000.00 Net incremental net income 63,000.0 $ 63, should The company purchase the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts