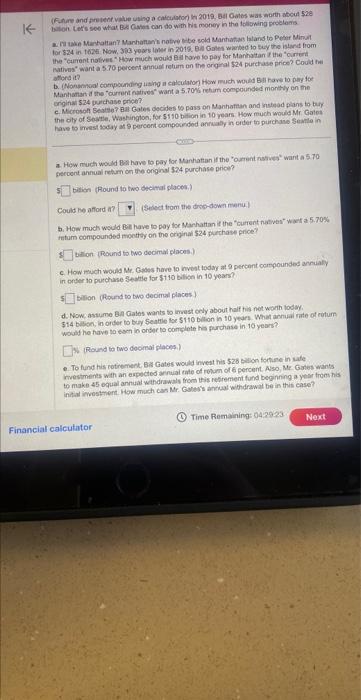

Question: K- (Future and present value using a calculator) In 2019, Bil Gates was worth about $28 billon Let's see what Bill Gates can do

K- (Future and present value using a calculator) In 2019, Bil Gates was worth about $28 billon Let's see what Bill Gates can do with his money in the following problems altake Manhattan? Manhattan's native bibe sold Manhattan Island to Peter Minut for $24 in 1626 Now, 383 years later in 2019, Bill Gates wanted to buy the island from the "current natives How much would Bill have to pay for Manhattan if the "current natives want a 5.70 percent annual retum on the original $24 purchase price? Could he afford it? b. (Nonannual compounding using a calculator) How much would Bill have to pay for Manhattan if the "current natives" want a 5.70% retum compounded monthly on the original $24 purchase price? c. Microsoft Seattle? Bill Gates decides to pass on Manhattan and instead plans to buy the city of Seattle, Washington, for $110 bilion in 10 years How much would Mr. Gates have to invest today at 9 percent compounded annually in order to purchase Seattle in a. How much would Bill have to pay for Manhattan if the "ourent natives" want a 5.70 percent annual retum on the original $24 purchase price? 5 billion (Round to two decimal places.) Could he afforda? (Select from the drop-down menu) b. How much would Bill have to pay for Manhattan if the "current natives" want a 5.70% retum compounded monthly on the original $24 purchase price? billion (Round to two decimal places.) c. How much would Mr. Gates have to invest today at 9 percent compounded annually in order to purchase Seattle for $110 billion in 10 years? $ billion (Round to two decimal places.) d. Now, assume Bill Gates wants to invest only about half his net worth today. $14 billion, in order to buy Seattle for $110 billion in 10 years. What annual rate of return would he have to eam in order to complete his purchase in 10 years? (Round to two decimal places.) e. To fund his retirement, B Gates would invest his $28 billion fortune in safe investments with an expected annual rate of retum of 6 percent. Also, Mr. Gates wants to make 45 equal annual withdrawals from this retirement fund beginning a year from his initial investment. How much can Mr. Gates's annual withdrawal be in this case? Financial calculator Time Remaining: 04:29:23 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts