Question: K IT 21) The current yield on a rero coupon bond (a) is always less than the coupon rate on the bond (b) might be

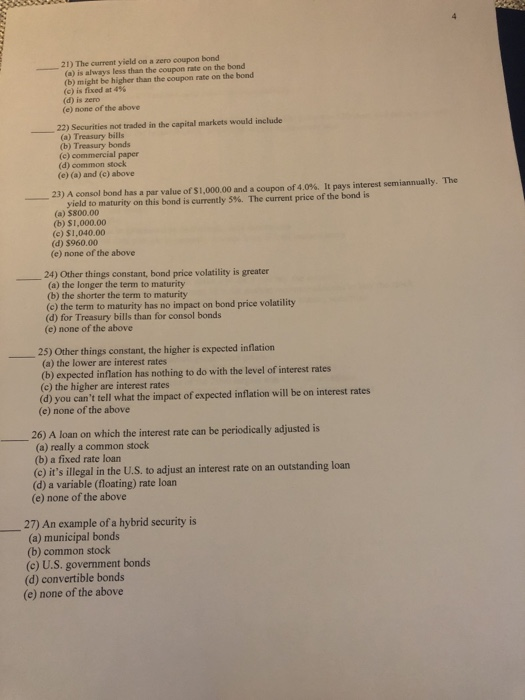

K IT 21) The current yield on a rero coupon bond (a) is always less than the coupon rate on the bond (b) might be higher than the coupon rate on the bond (c) is fixed at 496 (d) is zero (e) none of the above 22) Securities of traded in the capital markets would include (a) Treasury bills (b) Treasury bonds (e) commercial paper (d) common stock (e) (a) and (c) above 23) A consol bond has a par value of $1,000.00 and a coupon of 4.0%. It pays interest semiannually. The yield to maturity on this bond is currently 5%. The current price of the bond is (a) $800.00 (b) $1,000.00 (e) $1.040.00 (d) $960.00 (e) none of the above 24) Other things constant, bond price volatility is greater (a) the longer the term to maturity (b) the shorter the term to maturity (c) the term to maturity has no impact on bond price volatility (d) for Treasury bills than for consol bonds (e) none of the above 25) Other things constant, the higher is expected inflation (a) the lower are interest rates (b) expected inflation has nothing to do with the level of interest rates (c) the higher are interest rates (d) you can't tell what the impact of expected inflation will be on interest rates (e) none of the above 26) A loan on which the interest rate can be periodically adjusted is (a) really a common stock (b) a fixed rate loan (c) it's illegal in the U.S. to adjust an interest rate on an outstanding loan (d) a variable (floating) rate loan (e) none of the above 27) An example of a hybrid security is (a) municipal bonds (b) common stock (c) U.S. government bonds (d) convertible bonds (e) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts