Question: . K L M A B E G Decision to launch a new product: Moore pharmaceuticals has discovered a potential drug breakthrough in the lab.

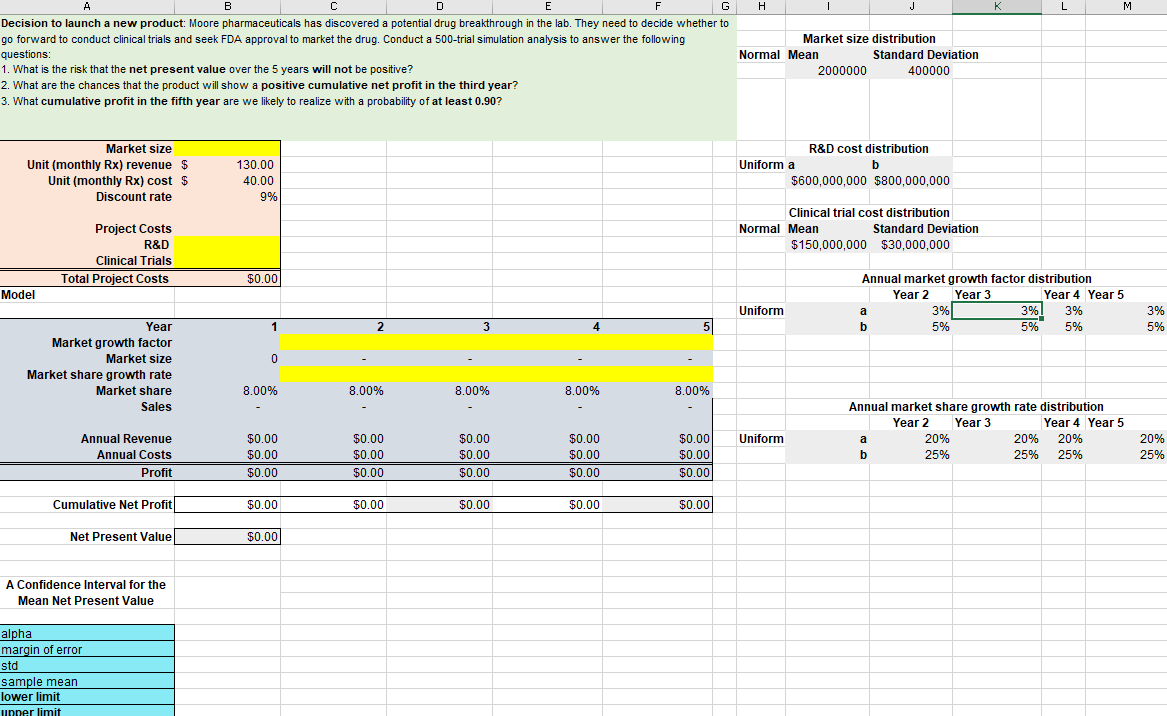

. K L M A B E G Decision to launch a new product: Moore pharmaceuticals has discovered a potential drug breakthrough in the lab. They need to decide whether to go forward to conduct clinical trials and seek FDA approval to market the drug. Conduct a 500-trial simulation analysis to answer the following questions: 1. What is the risk that the net present value over the 5 years will not be positive? 2. What are the chances that the product will show a positive cumulative net profit in the third year? 3. What cumulative profit in the fifth year are we likely to realize with a probability of at least 0.90? Market size distribution Normal Mean Standard Deviation 2000000 400000 Market size Unit (monthly Rx) revenue $ Unit (monthly Rx) cost $ Discount rate 130.00 40.00 9% R&D cost distribution Uniform a b $600,000,000 $800,000,000 Clinical trial cost distribution Normal Mean Standard Deviation $150,000,000 $30,000,000 Project Costs R&D Clinical Trials Total Project Costs $0.00 Model Uniform Annual market growth factor distribution Year 2 Year 3 Year 4 Year 5 a 3% 3% 3% b 5% 5% 5% 3% 5% 1 2 3 5 0 Year Market growth factor Market size Market share growth rate Market share Sales 8.00% 8.00% 8.00% 8.00% 8.00% Annual market share growth rate distribution Year 2 Year 3 Year 4 Year 5 a 20% 20% 20% b 25% 25% 25% Uniform Annual Revenue Annual Costs Profit $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 20% 25% Cumulative Net Profit $0.00 $0.00 $0.00 $0.00 $0.00 Net Present Value $0.00 A Confidence Interval for the Mean Net Present Value alpha margin of error std sample mean lower limit winner limit . K L M A B E G Decision to launch a new product: Moore pharmaceuticals has discovered a potential drug breakthrough in the lab. They need to decide whether to go forward to conduct clinical trials and seek FDA approval to market the drug. Conduct a 500-trial simulation analysis to answer the following questions: 1. What is the risk that the net present value over the 5 years will not be positive? 2. What are the chances that the product will show a positive cumulative net profit in the third year? 3. What cumulative profit in the fifth year are we likely to realize with a probability of at least 0.90? Market size distribution Normal Mean Standard Deviation 2000000 400000 Market size Unit (monthly Rx) revenue $ Unit (monthly Rx) cost $ Discount rate 130.00 40.00 9% R&D cost distribution Uniform a b $600,000,000 $800,000,000 Clinical trial cost distribution Normal Mean Standard Deviation $150,000,000 $30,000,000 Project Costs R&D Clinical Trials Total Project Costs $0.00 Model Uniform Annual market growth factor distribution Year 2 Year 3 Year 4 Year 5 a 3% 3% 3% b 5% 5% 5% 3% 5% 1 2 3 5 0 Year Market growth factor Market size Market share growth rate Market share Sales 8.00% 8.00% 8.00% 8.00% 8.00% Annual market share growth rate distribution Year 2 Year 3 Year 4 Year 5 a 20% 20% 20% b 25% 25% 25% Uniform Annual Revenue Annual Costs Profit $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 20% 25% Cumulative Net Profit $0.00 $0.00 $0.00 $0.00 $0.00 Net Present Value $0.00 A Confidence Interval for the Mean Net Present Value alpha margin of error std sample mean lower limit winner limit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts