Question: K . Martin, S . Harris, and E . White are forming The M H W Partnership. Martin is transferring ( $ 5

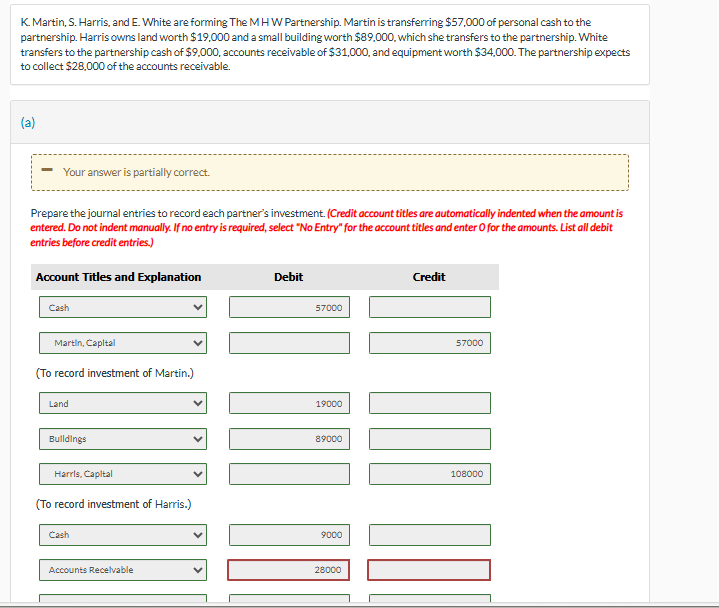

K Martin, S Harris, and E White are forming The M H W Partnership. Martin is transferring $ of personal cash to the partnership. Harris owns land worth $ and a small building worth $ which she transfers to the partnership. White transfers to the partnership cash of $ accounts receivable of $ and equipment worth $ The partnership expects to collect $ of the accounts receivable. a Your answer is partially correct. Prepare the journal entries to record each partner's investment. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries. Account Titles and Explanation Debit Credit To record investment of Martin.To record investment of Harris. Prepare a classified balance sheet for the partnership after the partners' investments, as of December List current assets in order of liquidity.

THE MHW PARTNERSHIP Balance Sheet Partial

December

Assets

$

$

$ $

Liabilities and Owners' Equity

$

$ Liabilities and Owners' Equity

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock