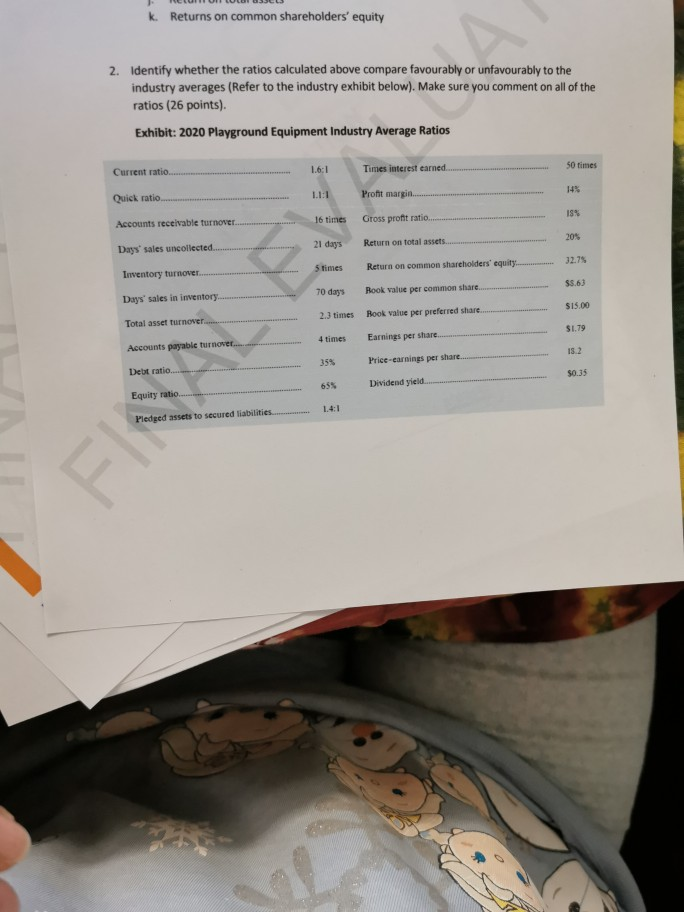

Question: k Returns on common shareholders' equity 2. Identify whether the ratios calculated above compare favourably or unfavourably to the industry averages (Refer to the industry

k Returns on common shareholders' equity 2. Identify whether the ratios calculated above compare favourably or unfavourably to the industry averages (Refer to the industry exhibit below). Make sure you comment on all of the ratios (26 points) Exhibit: 2020 Playground Equipment Industry Average Ratios Current ratio..... 16:1 Times interest earned............... 50 times Pront margin......................... Quick ratio....... Accounts receivable turnover... 16 times Gross profit ratio............ Days' sales uncollected............................ 21 days Return on total assets.... 32.75 5 times Return on common shareholders' equity.......... Inventory turnover....................... ..... $5.63 Rook value per common share Days' sales in inventory.......................... $15.00 2.3 times Book value per preferred share............. Total asset turnover................................. $1.79 4 times Earnings per share... Accounts payable turnover................ 35% Price-earnings per share... Debt ratio..... . 65% Dividend yield. Equity ratio..... . 1.4:1 Pledged assets to secured liabilities. k Returns on common shareholders' equity 2. Identify whether the ratios calculated above compare favourably or unfavourably to the industry averages (Refer to the industry exhibit below). Make sure you comment on all of the ratios (26 points) Exhibit: 2020 Playground Equipment Industry Average Ratios Current ratio..... 16:1 Times interest earned............... 50 times Pront margin......................... Quick ratio....... Accounts receivable turnover... 16 times Gross profit ratio............ Days' sales uncollected............................ 21 days Return on total assets.... 32.75 5 times Return on common shareholders' equity.......... Inventory turnover....................... ..... $5.63 Rook value per common share Days' sales in inventory.......................... $15.00 2.3 times Book value per preferred share............. Total asset turnover................................. $1.79 4 times Earnings per share... Accounts payable turnover................ 35% Price-earnings per share... Debt ratio..... . 65% Dividend yield. Equity ratio..... . 1.4:1 Pledged assets to secured liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts