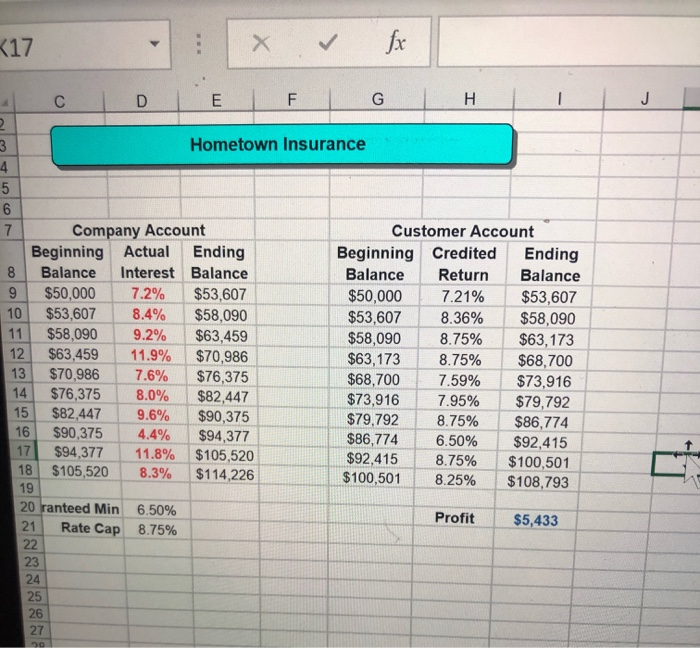

Question: K17 - : * fx ac IDE I L I G H III Hometown Insurance Company Account Beginning Actual Ending 8 Balance Interest Balance 9

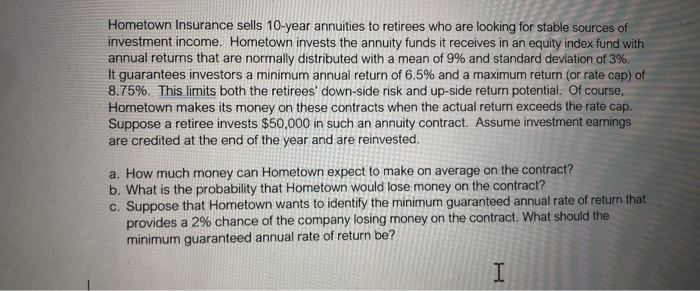

K17 - : * fx ac IDE I L I G H III Hometown Insurance Company Account Beginning Actual Ending 8 Balance Interest Balance 9 $50,000 7.2% $53,607 10 $53,607 8.4% $58,090 11 $58,090 9.2% $63,459 12 $63,459 11.9% $70,986 13 $70,986 7.6% $76,375 $76,375 8.0% $82,447 15 $82,447 9.6% $90,375 16 $90,375 4.4% $94,377 17 $94.377 11.8% $105,520 18 $105,520 8.3% $114,226 19 20 ranteed Min 6.50% 21 Rate Cap 8.75% Customer Account Beginning Credited Ending Balance Return Balance $50,000 7.21% $53,607 $53,607 8.36% $58,090 $58,090 8.75% $63,173 $63,173 8.75% $68,700 $68,700 7.59% $73,916 $73,916 7.95% $79,792 $79.792 8.75% $86,774 $86,774 6.50% $92,415 $92,415 8.75% $100,501 $100,501 8.25% $108,793 14 Profit $5,433 Hometown Insurance sells 10-year annuities to retirees who are looking for stable sources of investment income. Hometown invests the annuity funds it receives in an equity index fund with annual returns that are normally distributed with a mean of 9% and standard deviation of 3%. It guarantees investors a minimum annual return of 6.5% and a maximum return (or rate cap) of 8.75%. This limits both the retirees' down-side risk and up-side return potential. Of course, Hometown makes its money on these contracts when the actual return exceeds the rate cap. Suppose a retiree invests $50,000 in such an annuity contract. Assume investment earnings are credited at the end of the year and are reinvested. a. How much money can Hometown expect to make on average on the contract? b. What is the probability that Hometown would lose money on the contract? c. Suppose that Hometown wants to identify the minimum guaranteed annual rate of return that provides a 2% chance of the company losing money on the contract. What should the minimum guaranteed annual rate of return be? K17 - : * fx ac IDE I L I G H III Hometown Insurance Company Account Beginning Actual Ending 8 Balance Interest Balance 9 $50,000 7.2% $53,607 10 $53,607 8.4% $58,090 11 $58,090 9.2% $63,459 12 $63,459 11.9% $70,986 13 $70,986 7.6% $76,375 $76,375 8.0% $82,447 15 $82,447 9.6% $90,375 16 $90,375 4.4% $94,377 17 $94.377 11.8% $105,520 18 $105,520 8.3% $114,226 19 20 ranteed Min 6.50% 21 Rate Cap 8.75% Customer Account Beginning Credited Ending Balance Return Balance $50,000 7.21% $53,607 $53,607 8.36% $58,090 $58,090 8.75% $63,173 $63,173 8.75% $68,700 $68,700 7.59% $73,916 $73,916 7.95% $79,792 $79.792 8.75% $86,774 $86,774 6.50% $92,415 $92,415 8.75% $100,501 $100,501 8.25% $108,793 14 Profit $5,433 Hometown Insurance sells 10-year annuities to retirees who are looking for stable sources of investment income. Hometown invests the annuity funds it receives in an equity index fund with annual returns that are normally distributed with a mean of 9% and standard deviation of 3%. It guarantees investors a minimum annual return of 6.5% and a maximum return (or rate cap) of 8.75%. This limits both the retirees' down-side risk and up-side return potential. Of course, Hometown makes its money on these contracts when the actual return exceeds the rate cap. Suppose a retiree invests $50,000 in such an annuity contract. Assume investment earnings are credited at the end of the year and are reinvested. a. How much money can Hometown expect to make on average on the contract? b. What is the probability that Hometown would lose money on the contract? c. Suppose that Hometown wants to identify the minimum guaranteed annual rate of return that provides a 2% chance of the company losing money on the contract. What should the minimum guaranteed annual rate of return be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts