Question: K9 X fx I J K A B D E F G H 524 Question 5: Suppose 5 years have passed since the MPTS in

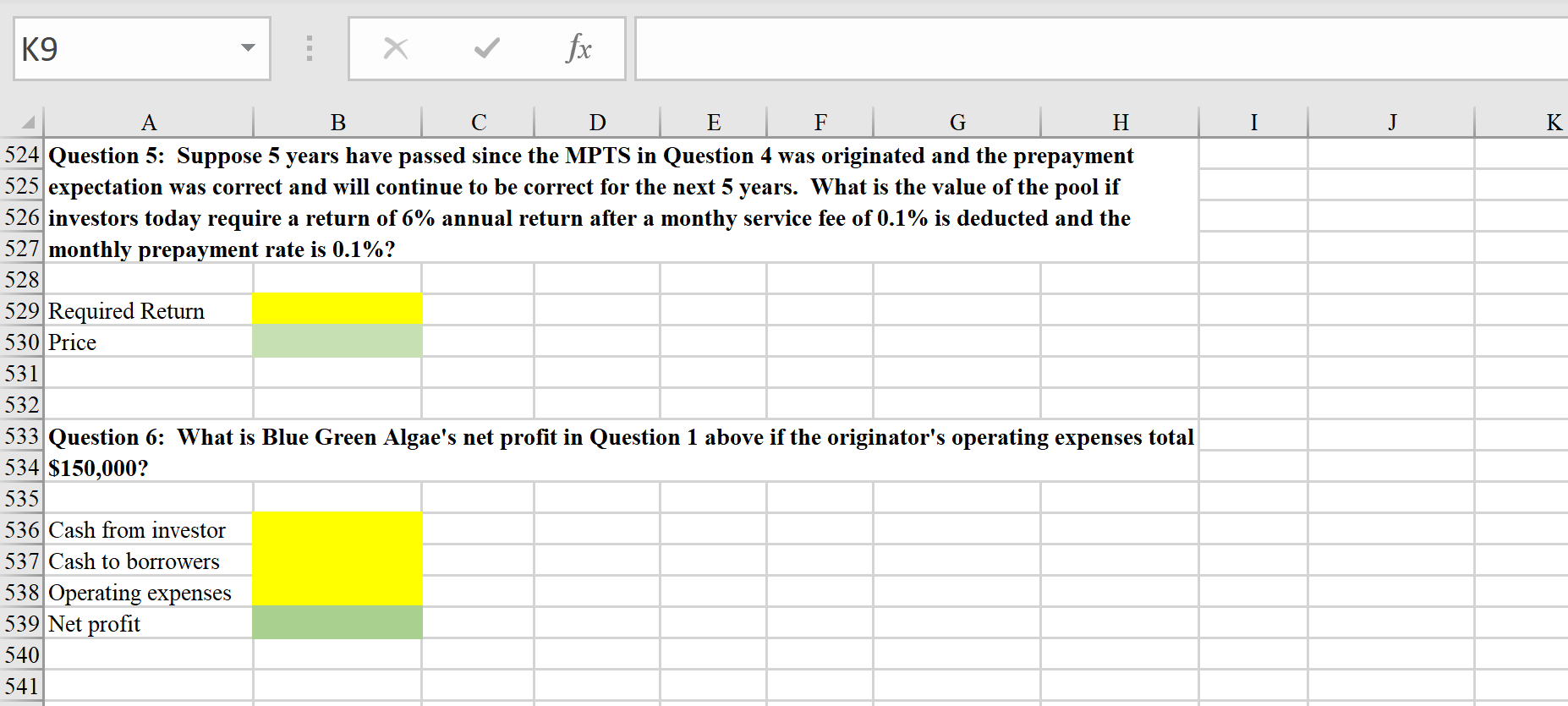

K9 X fx I J K A B D E F G H 524 Question 5: Suppose 5 years have passed since the MPTS in Question 4 was originated and the prepayment 525 expectation was correct and will continue to be correct for the next 5 years. What is the value of the pool if 526 investors today require a return of 6% annual return after a monthy service fee of 0.1% is deducted and the 527 monthly prepayment rate is 0.1%? 528 529 Required Return 530 Price 531 532 533 Question 6: What is Blue Green Algae's net profit in Question 1 above if the originator's operating expenses total 534 $150,000? 535 536 Cash from investor 537 Cash to borrowers 538 Operating expenses 539 Net profit 540 541 K9 X fx I J K A B D E F G H 524 Question 5: Suppose 5 years have passed since the MPTS in Question 4 was originated and the prepayment 525 expectation was correct and will continue to be correct for the next 5 years. What is the value of the pool if 526 investors today require a return of 6% annual return after a monthy service fee of 0.1% is deducted and the 527 monthly prepayment rate is 0.1%? 528 529 Required Return 530 Price 531 532 533 Question 6: What is Blue Green Algae's net profit in Question 1 above if the originator's operating expenses total 534 $150,000? 535 536 Cash from investor 537 Cash to borrowers 538 Operating expenses 539 Net profit 540 541

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts