Question: Kaplan Brewery is considering either purchasing or leasing a $1,000,000 piece of specialized equipment, which would generate $224,000 of incremental sales for Kaplan for each

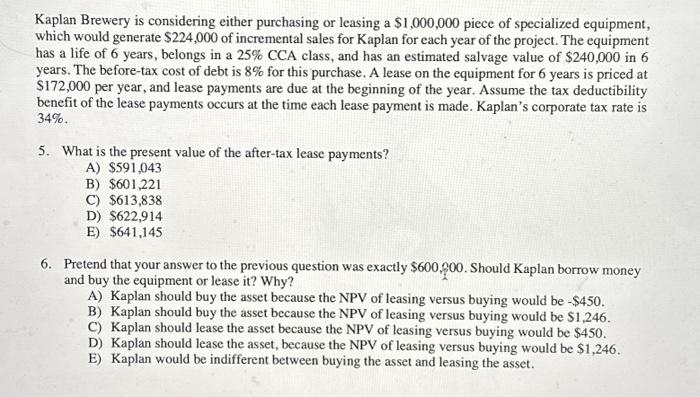

Kaplan Brewery is considering either purchasing or leasing a $1,000,000 piece of specialized equipment, which would generate $224,000 of incremental sales for Kaplan for each year of the project. The equipment has a life of 6 years, belongs in a 25\% CCA class, and has an estimated salvage value of $240,000 in 6 years. The before-tax cost of debt is 8% for this purchase. A lease on the equipment for 6 years is priced at $172,000 per year, and lease payments are due at the beginning of the year. Assume the tax deductibility benefit of the lease payments occurs at the time each lease payment is made. Kaplan's corporate tax rate is 34% 5. What is the present value of the after-tax lease payments? A) $591,043 B) $601,221 C) $613,838 D) $622,914 E) $641,145 6. Pretend that your answer to the previous question was exactly $600,2,00. Should Kaplan borrow money and buy the equipment or lease it? Why? A) Kaplan should buy the asset because the NPV of leasing versus buying would be $450. B) Kaplan should buy the asset because the NPV of leasing versus buying would be $1,246. C) Kaplan should lease the asset because the NPV of leasing versus buying would be $450. D) Kaplan should lease the asset, because the NPV of leasing versus buying would be $1,246. E) Kaplan would be indifferent between buying the asset and leasing the asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts