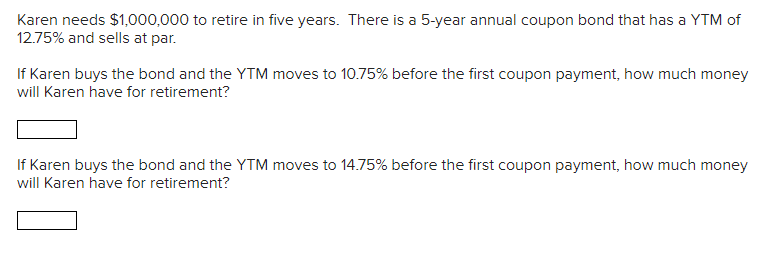

Question: Karen needs $ 1 , 0 0 0 , 0 0 0 to retire in five years. There is a 5 - year annual coupon

Karen needs $ to retire in five years. There is a year annual coupon bond that has a YTM of

and sells at par.

If Karen buys the bond and the YTM moves to before the first coupon payment, how much money

will Karen have for retirement?

If Karen buys the bond and the YTM moves to before the first coupon payment, how much money

will Karen have for retirement?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock