Question: Kari is purchasing a home for $260,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at

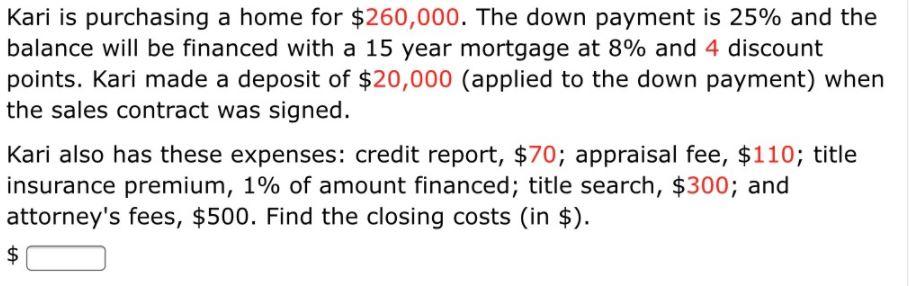

Kari is purchasing a home for $260,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 4 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $300; and attorney's fees, $500. Find the closing costs (in $). %24

Step by Step Solution

3.60 Rating (157 Votes )

There are 3 Steps involved in it

A B 1 2 Amount 3 Down payment 260000 25 260000025 4 Add 5 Finance... View full answer

Get step-by-step solutions from verified subject matter experts