Question: Kate's gross pay is $ 5 , 4 0 0 and take - home pay is $ 4 , 0 0 0 . If Kate

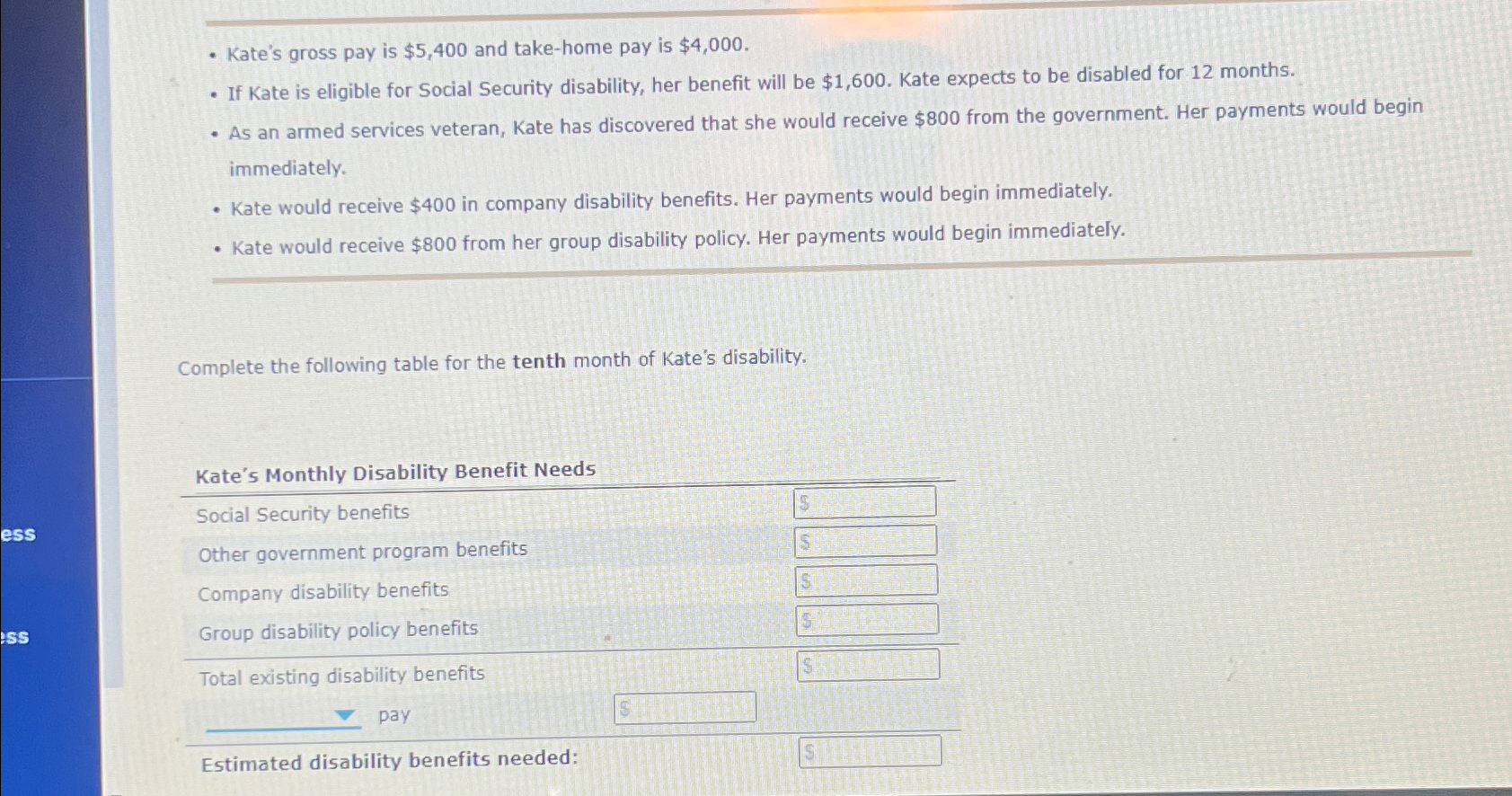

Kate's gross pay is $ and takehome pay is $

If Kate is eligible for Social Security disability, her benefit will be $ Kate expects to be disabled for months.

As an armed services veteran, Kate has discovered that she would receive $ from the government. Her payments would begin immediately.

Kate would receive $ in company disability benefits. Her payments would begin immediately.

Kate would receive $ from her group disability policy. Her payments would begin immediately.

Complete the following table for the tenth month of Kate's disability.

Kate's Monthly Disability Benefit Needs

Social Security benefits

Other government program benefits

Company disability benefits

Group disability policy benefits

Total existing disability benefits

pay

Estimated disability benefits needed:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock