Question: Kathy Weimer has prepared a report on the interest rate sensitivity of a bond for her supervisor, Steve Slykhuis, assuming a 75 basis point change

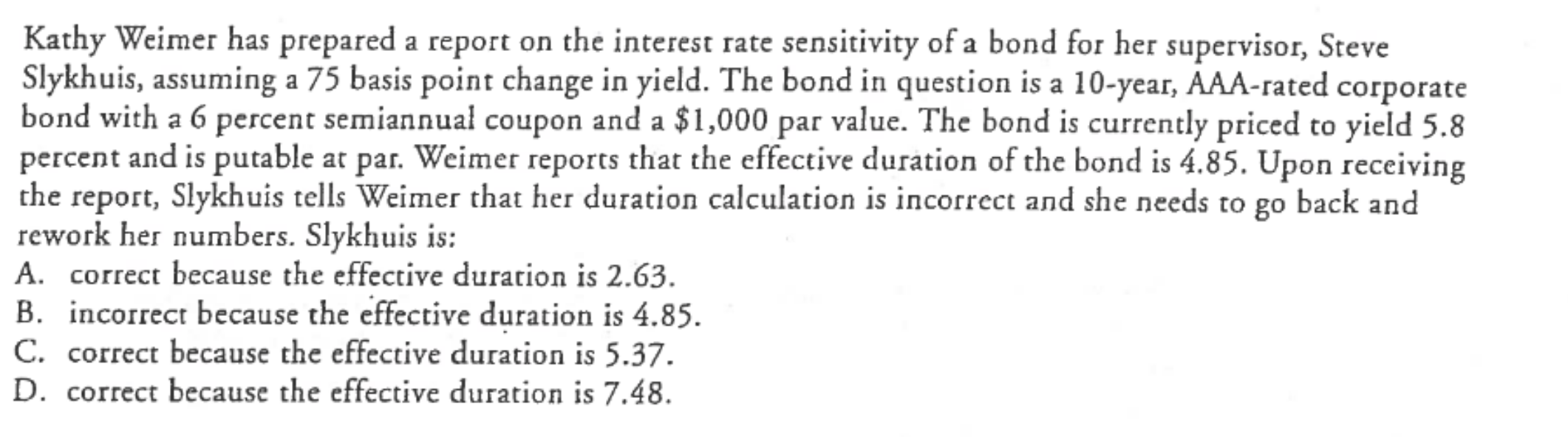

Kathy Weimer has prepared a report on the interest rate sensitivity of a bond for her supervisor, Steve Slykhuis, assuming a 75 basis point change in yield. The bond in question is a 10-year, AAA-rated corporate bond with a 6 percent semiannual coupon and a $1,000 par value. The bond is currently priced to yield 5.8 percent and is putable at par. Weimer reports that the effective duration of the bond is 4.85 . Upon receiving the report, Slykhuis tells Weimer that her duration calculation is incorrect and she needs to go back and rework her numbers. Slykhuis is: A. correct because the effective duration is 2.63 . B. incorrect because the effective duration is 4.85 . C. correct because the effective duration is 5.37. D. correct because the effective duration is 7.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts