Question: Katie's project has a four-year term, a first cost, no salvage value, and annual savings of $20,000 per year. After doing present worth and annual

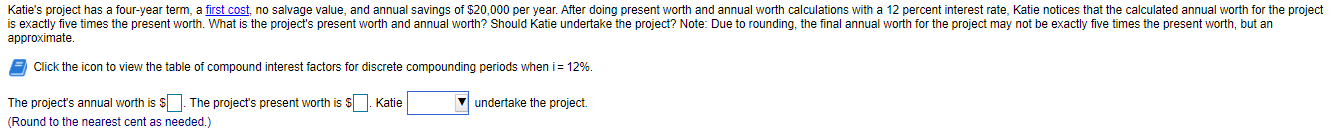

Katie's project has a four-year term, a first cost, no salvage value, and annual savings of $20,000 per year. After doing present worth and annual worth calculations with a 12 percent interest rate, Katie notices that the calculated annual worth for the project is exactly five times the present worth. What is the project's present worth and annual worth? Should Katie undertake the project? Note: Due to rounding, the final annual worth for the project may not be exactly five times the present worth, but an approximate Click the icon to view the table of compound interest factors for discrete compounding periods when i= 12%. undertake the project. The project's annual worth is $. The project's present worth is $. Katie (Round to the nearest cent as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts