Question: Katy Enterprises, LLC borrows $ 1 , 0 0 0 , 0 0 0 at 5 % interest for one year to build a headquarters

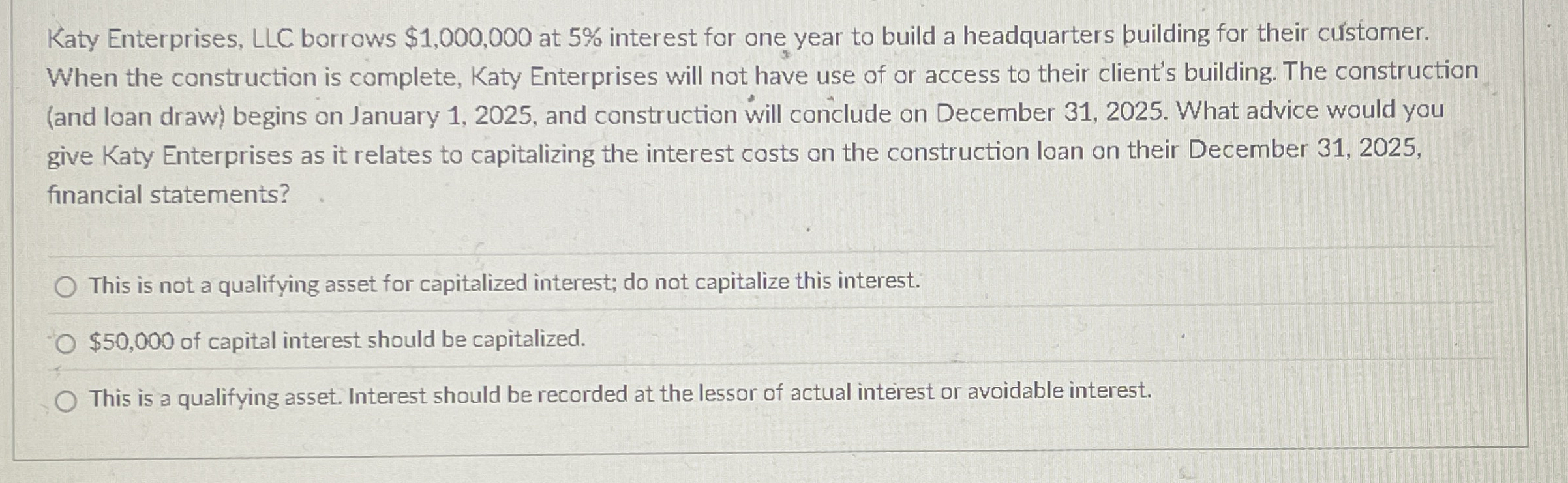

Katy Enterprises, LLC borrows $ at interest for one year to build a headquarters building for their customer. When the construction is complete, Katy Enterprises will not have use of or access to their client's building. The construction and loan draw begins on January and construction will conclude on December What advice would you give Katy Enterprises as it relates to capitalizing the interest costs on the construction loan on their December financial statements?

This is not a qualifying asset for capitalized interest; do not capitalize this interest.

$ of capital interest should be capitalized.

This is a qualifying asset. Interest should be recorded at the lessor of actual interest or avoidable interest.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock