Question: Keading 1 : A primer on CDSs This is based on the reading Bond Basics: What are Credit Default Swaps and how do they work?,

Keading : A primer on CDSs

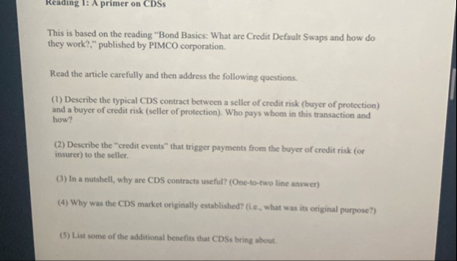

This is based on the reading "Bond Basics: What are Credit Default Swaps and how do they work?," published by PIMCO corporation.

Read the article carefully and then address the following questions.

Describe the typical CDS contract between a seller of credit risk buycr of protection and a buyer of credit risk seller of protection Who pays whom in this transaction and how?

Describe the "credit events" that trigger payments from the buyer of credit risk or insurer to the seller.

In a mutshell, why are CDS contracts useful? Onetotwo line anwwer

Why wes the C martet orfytratty eathtinhont The what was its eriginal purpose?

List some of the additional benefits that CDSs bring about.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock