Question: keep 4 post decimal digits when entering your final answer and keep 4 post decimal digits in all intermediate steps. Astock has a beta of

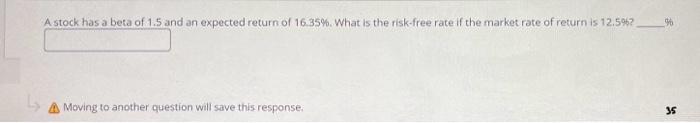

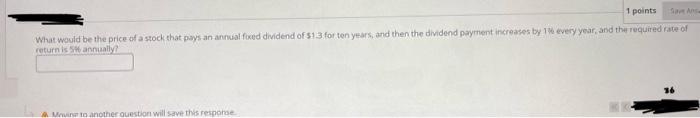

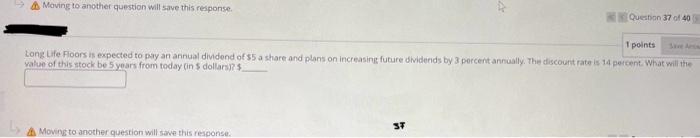

Astock has a beta of 1.5 and an expected return of 16.35%. What is the risk-free rate if the market rate of return is 12.5% ? % Moving to another question will save this response. 35 What would be the price of a stock that pays an annual foxed dividend of $13 for ten years, and then the dividend payment increases by 1 whe every year, and the required rate of raturn is Sit annuailv? Long Life Fioors is expected to pay an annual dividend of $5 a share and plans on increasing fucure dividends by 3 percent annually. The discount rate is 14 percent. What wili the value of this stock be 5 vears from today (in $ dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts