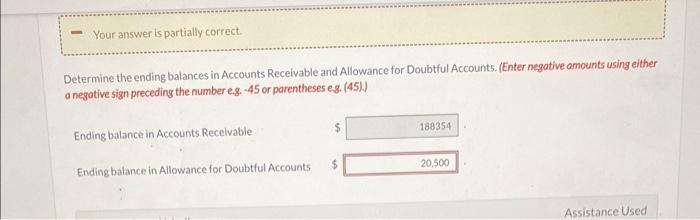

Question: keep being told its 20,500 but the answer is wrong. Enter the beginning balances for Accounts Receivable and Allowance for Doubtful Accounts in a tabular

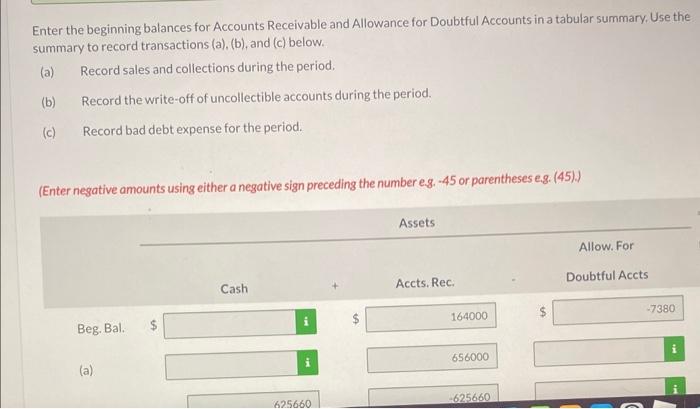

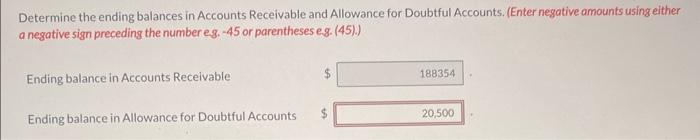

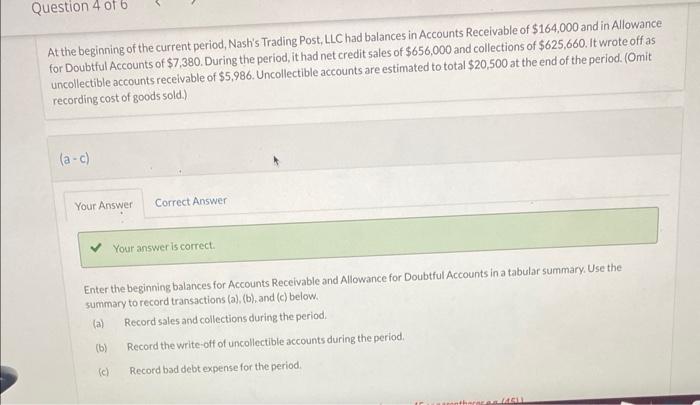

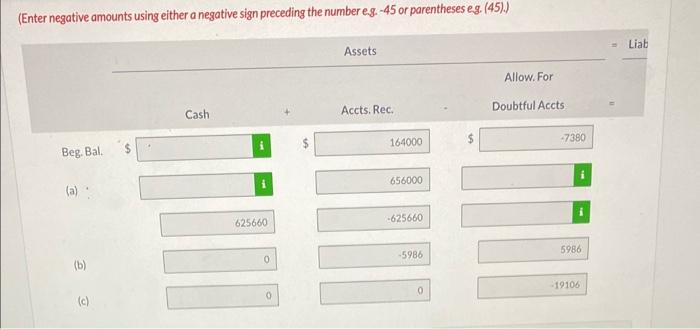

Enter the beginning balances for Accounts Receivable and Allowance for Doubtful Accounts in a tabular summary. Use the summary to record transactions (a), (b), and (c) below. (a) Record sales and collections during the period. (b) Record the write-off of uncollectible accounts during the period. (c) Record bad debt expense for the period. Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45).) Ending balance in Accounts Receivable Ending balance in Allowance for Doubtful Accounts At the beginning of the current period, Nash's Trading Post, LLC had balances in Accounts Receivable of $164,000 and in Allowance for Doubtful Accounts of $7,380. During the period, it had net credit sales of $656,000 and collections of $625,660. It wrote off as uncollectible accounts receivable of $5,986. Uncollectible accounts are estimated to total $20,500 at the end of the period. (Omit recording cost of goods sold.) (ac) Your answer is correct. Enter the beginning balances for Accounts Recelvable and Allowance for Doubtful Accounts in a tabular summary. Use the summary to record transactions (a), (b), and (c) below. (a) Record sales and collections during the period. (b) Record the write-off of uncollectible accounts during the period. (c) Record bad debt expense for the period. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45).) Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. (Enter negative amounts using either a negotive sign preceding the number e.g. -45 or parentheses eg. (45).) Ending balance in Accounts Recelvable Ending balance in Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts