Question: keep getting these answers wrong Answer questions 1 - 8 for a $250,000 home purchase using a conventional fixed rate mortgage from a private lender.

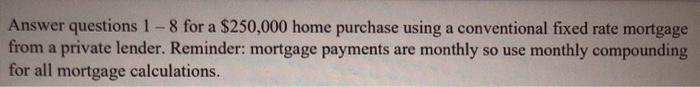

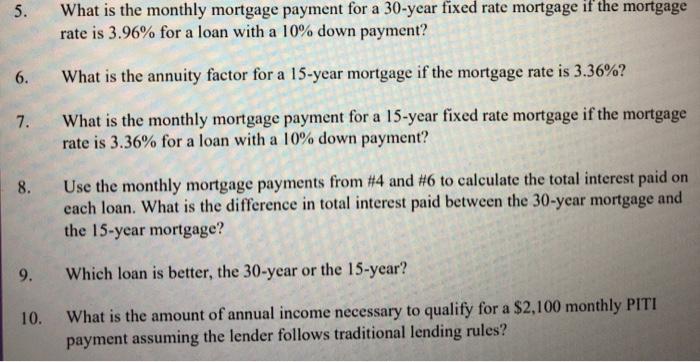

Answer questions 1 - 8 for a $250,000 home purchase using a conventional fixed rate mortgage from a private lender. Reminder: mortgage payments are monthly so use monthly compounding for all mortgage calculations. 5. What is the monthly mortgage payment for a 30-year fixed rate mortgage if the mortgage rate is 3.96% for a loan with a 10% down payment? 6. What is the annuity factor for a 15-year mortgage if the mortgage rate is 3.36%? 7. What is the monthly mortgage payment for a 15-year fixed rate mortgage if the mortgage rate is 3.36% for a loan with a 10% down payment? 8. Use the monthly mortgage payments from #4 and #6 to calculate the total interest paid on each loan. What is the difference in total interest paid between the 30-year mortgage and the 15-year mortgage? 9. Which loan is better, the 30-year or the 15-year? 10. What is the amount of annual income necessary to qualify for a $2,100 monthly PITI payment assuming the lender follows traditional lending rules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts