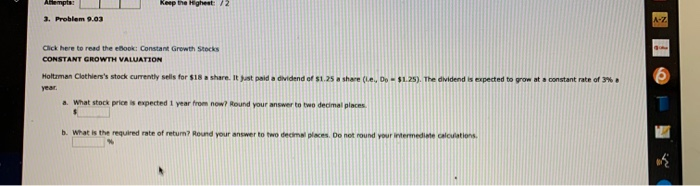

Question: Keep the Highest: /2 Attempts 3. Problem 9.03 A-Z Click here to read the book Constant Growth Stocks CONSTANT GROWTH VALUATION Holtaman Clothiers's stock currently

Keep the Highest: /2 Attempts 3. Problem 9.03 A-Z Click here to read the book Constant Growth Stocks CONSTANT GROWTH VALUATION Holtaman Clothiers's stock currently sells for $18 share it sot paid a dividend of 51.25 share (ie, Dp - $12). The dividend is expected to grow at a constant rate of 3. year a. What stock price is expected 1 year from now? Round your answer to two decimal places b. What is the required rate of return? Round your answer to two decimal places. Do not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts