Question: keep the highest: 8. Problem 7.06 (Bond Valuation) An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in

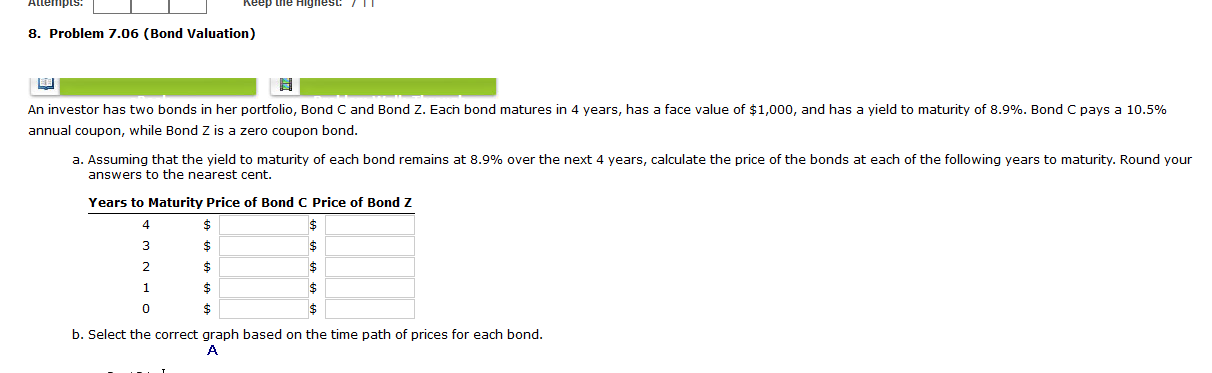

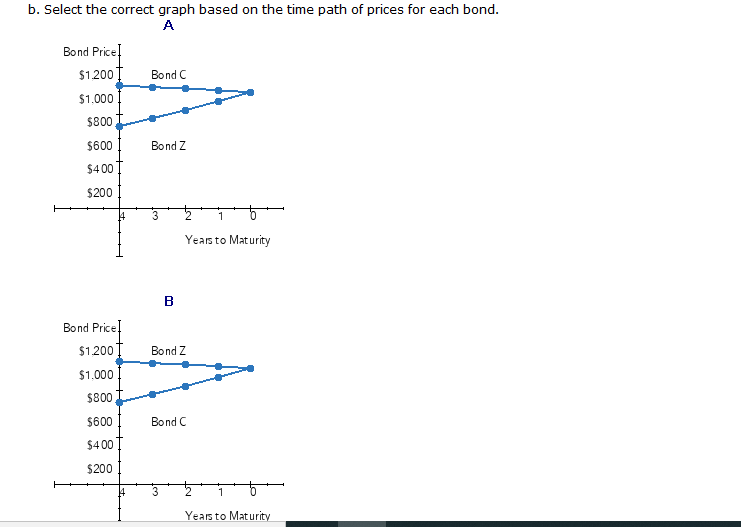

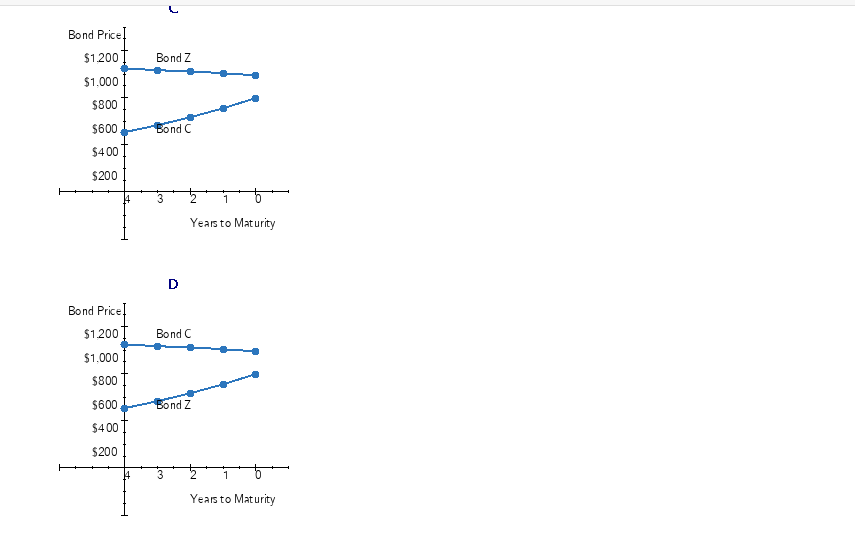

keep the highest: 8. Problem 7.06 (Bond Valuation) An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.9%. Bond C pays a 10.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.9% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ 3 $ $ 2 $ $ 1 $ $ 0 $ b. Select the correct graph based on the time path of prices for each bond. A b. Select the correct graph based on the time path of prices for each bond. A Bond Price! $1.200 Bond C $1.000 $800 $600 Bond Z $400 $200 14 3 2 1 Years to Maturity B Bond Price $1.200 Bond Z $1.000 $800 $600 Bond C $400 $200 3 2 1 t. Years to Maturity Bond Price! $1.200 Bond Z $1.000 $800 $600 Bond C $400 $200 3 1 Years to Maturity D Bond Price] $1200 $1.000 Bond C $800 $600 Bond Z $400 $200 3 1 Years to Maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts